Decentralized Finance (DeFi) and Blockchain

Mia Wilson

Photo: Decentralized Finance (DeFi) and Blockchain

In the rapidly evolving world of finance, a revolutionary concept known as Decentralized Finance (DeFi) is gaining traction, promising to reshape traditional financial systems. DeFi leverages blockchain technology to create an open and transparent financial ecosystem, free from the control of central authorities. This article aims to provide an in-depth exploration of DeFi, its underlying blockchain technology, and the potential it holds for the future of finance. By understanding its core principles and applications, readers will gain valuable insights into this transformative movement.

Understanding Decentralized Finance

What is DeFi?

Decentralized Finance, or DeFi, represents a paradigm shift in the way financial services are delivered and accessed. It is a rapidly growing ecosystem of financial applications built on blockchain networks, primarily on the Ethereum blockchain. DeFi aims to recreate traditional financial instruments and services in a decentralized manner, removing intermediaries and providing users with full control over their assets.

At its core, DeFi is based on the principles of transparency, accessibility, and financial inclusion. It enables anyone with an internet connection to participate in a global financial network, offering a wide range of services such as lending, borrowing, trading, and investing, all without the need for traditional banks or financial institutions.

Key Features of DeFi

- Decentralization: DeFi platforms operate on decentralized networks, ensuring that no single entity has control over the system. This decentralization enhances security and reduces the risk of censorship or manipulation.

- Smart Contracts: Smart contracts are self-executing contracts with the terms of the agreement directly written into code. They automatically enforce and execute transactions, removing the need for intermediaries and reducing counterparty risk.

- Open and Permissionless: Anyone can access and participate in DeFi platforms without the need for approval from a central authority. This inclusivity fosters a global financial community.

- Transparency: All transactions on a blockchain are recorded on a public ledger, ensuring transparency and auditability. This transparency builds trust and allows for easy verification of transactions.

- Interoperability: DeFi protocols are designed to work seamlessly with each other, allowing users to move assets between different applications easily.

The Role of Blockchain in DeFi

Blockchain Technology Explained

Blockchain is the foundational technology that powers DeFi and ensures its success. It is a distributed ledger system that maintains a continuously growing list of records called blocks, secured by cryptographic techniques. Each block contains a timestamp and a link to the previous block, forming a chain. This structure provides an immutable and transparent record of transactions.

In the context of DeFi, blockchain technology offers several key advantages:

- Security: Blockchain's distributed nature makes it extremely difficult for malicious actors to manipulate or compromise the system. Transactions are secured through cryptographic algorithms, ensuring the integrity of the data.

- Transparency: All transactions on a blockchain are visible to network participants, fostering trust and accountability. This transparency enables users to verify the history of assets and transactions, reducing the potential for fraud.

- Immutability: Once data is recorded on the blockchain, it becomes extremely difficult to alter or delete. This immutability ensures the integrity of financial records, making it ideal for maintaining a transparent and reliable financial system.

- Smart Contract Integration: Blockchain's ability to execute smart contracts is a cornerstone of DeFi. These contracts automate financial agreements, reducing the need for intermediaries and minimizing the risk of human error.

Exploring DeFi Applications

Lending and Borrowing

One of the most popular use cases of DeFi is lending and borrowing. DeFi lending platforms allow users to lend their crypto assets and earn interest, while borrowers can access loans without the need for credit checks or traditional banking processes. These platforms utilize smart contracts to automate the lending process, ensuring transparency and security. Users can choose from various lending models, including peer-to-peer lending and liquidity pools, offering flexibility and competitive interest rates.

Decentralized Exchanges (DEXs)

Decentralized exchanges are platforms that facilitate the trading of cryptocurrencies without the need for intermediaries. DEXs enable users to trade directly from their crypto wallets, ensuring they maintain control over their assets. These exchanges often employ automated market-making algorithms, providing liquidity and enabling seamless trading experiences. DEXs promote financial freedom and eliminate the risk of centralized exchange hacks or manipulation.

Yield Farming and Liquidity Provision

Yield farming is a process where users provide liquidity to decentralized finance protocols and earn rewards in return. By locking their crypto assets into liquidity pools, users can earn a share of the trading fees generated by the platform. This mechanism incentivizes users to contribute to the liquidity of the platform, ensuring sufficient funds are available for lending, borrowing, and trading activities.

Benefits and Challenges of DeFi

Advantages of DeFi

- Financial Inclusion: DeFi has the potential to bring financial services to the unbanked and underbanked populations, providing them with access to lending, borrowing, and investment opportunities.

- Lower Costs: By removing intermediaries, DeFi platforms can offer lower fees for various financial services, making it more affordable for users.

- Transparency and Security: The transparent nature of blockchain ensures that transactions are secure and auditable, reducing the risk of fraud and manipulation.

- Global Accessibility: DeFi applications are accessible to anyone with an internet connection, enabling global participation in the financial ecosystem.

Challenges and Risks

- Smart Contract Vulnerabilities: Smart contracts, while powerful, can contain vulnerabilities that malicious actors may exploit. This has led to several high-profile hacks in the DeFi space.

- Regulatory Uncertainty: The decentralized nature of DeFi poses challenges for regulators, leading to legal and compliance uncertainties.

- Volatility and Market Risk: The cryptocurrency market is known for its volatility, which can impact the value of assets held in DeFi protocols.

- User Experience: DeFi applications often require a certain level of technical understanding, which may deter mainstream adoption. Improving user interfaces and simplifying the user experience is crucial for wider acceptance.

The Future of DeFi and Blockchain

The DeFi space is evolving rapidly, attracting significant attention from investors and developers alike. As the industry matures, we can expect to see continued innovation in DeFi applications, addressing current challenges and enhancing user experiences. The integration of blockchain technology with traditional finance is also an area of exploration, as it offers the potential to streamline processes and increase efficiency.

Moreover, the regulatory landscape is likely to play a crucial role in shaping the future of DeFi. As governments and regulatory bodies grapple with the unique challenges posed by decentralized finance, clear guidelines and frameworks will be essential to fostering trust and attracting institutional investment.

Conclusion: Unlocking the Potential of DeFi

Decentralized Finance represents a significant shift towards a more open, transparent, and inclusive financial system. By leveraging blockchain technology, DeFi applications are transforming the way people interact with financial services, offering unprecedented control and accessibility.

While the DeFi space is still evolving and facing various challenges, its potential to disrupt traditional finance is undeniable. As the technology matures and regulatory frameworks develop, DeFi is poised to become a mainstream financial alternative, empowering individuals and challenging the status quo.

The journey towards a decentralized financial ecosystem is an exciting prospect, and the continued exploration and adoption of DeFi applications will shape the future of finance, making it more accessible, efficient, and secure for all participants. Embracing the potential of DeFi and blockchain technology can lead to a more inclusive and innovative financial landscape.

For You

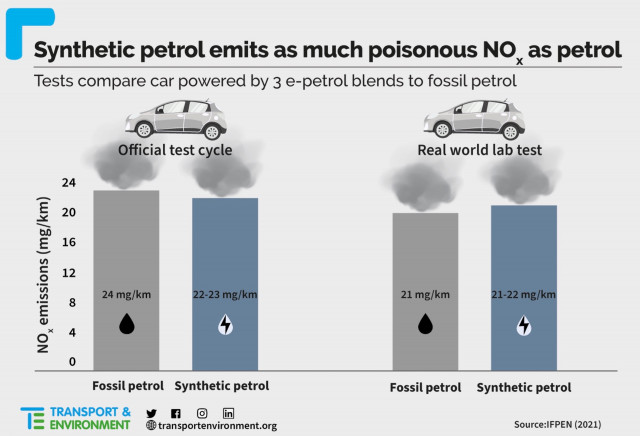

View AllCompare synthetic fuel and diesel to understand their benefits, drawbacks, and environmental impact. Find the best option!

Mia Wilson

Explore how AI is revolutionizing healthcare and improving patient outcomes.

Mia Wilson

Uncover the truth about blockchain's environmental impact and sustainability efforts.

Mia Wilson

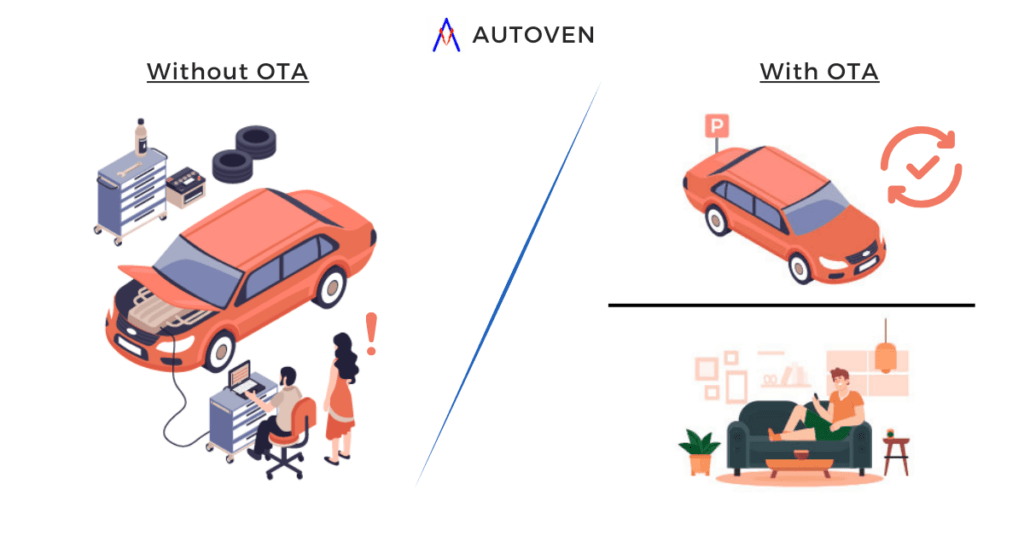

Learn how over-the-air (OTA) updates work in modern cars and why they’re crucial for performance and safety. Stay informed!

Mia Wilson

Discover the top 10 adventure destinations around the world. From hiking to diving, find your next thrilling escape today!

Mia Wilson

Explore how driverless bus technology is changing public transport. Learn about safety, efficiency, and the future of transit!

Mia Wilson

Education

View All

May 7, 2025

What Is a Liberal Arts Education?

Uncover the value of a liberal arts education and how it shapes versatile, well-rounded individuals. Learn why it matters!

May 14, 2025

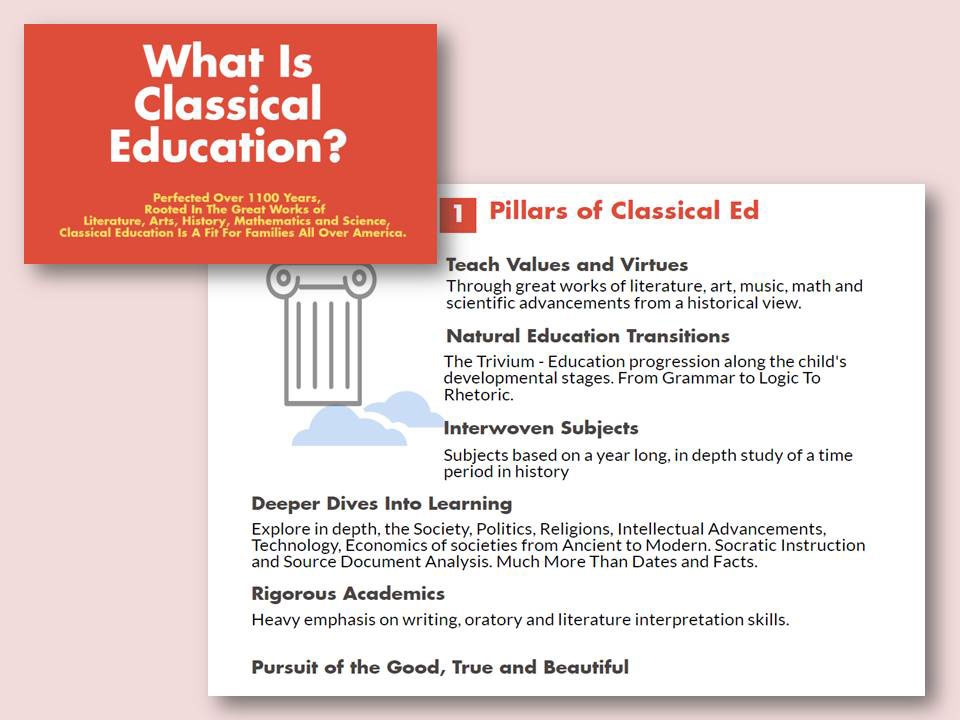

What Is Classical Education? Explained!

Discover the principles of classical education, its history, and how it fosters critical thinking. Learn the benefits today!

May 3, 2025

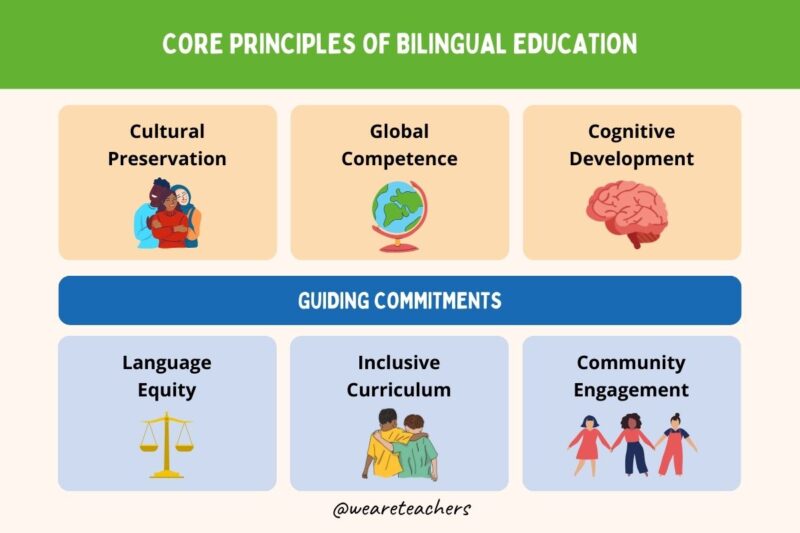

What Is Bilingual Education?

Explore bilingual education, its benefits, and how it fosters cultural understanding and cognitive growth. Learn more!