Economic Forecasting Methods Simplified

Mia Wilson

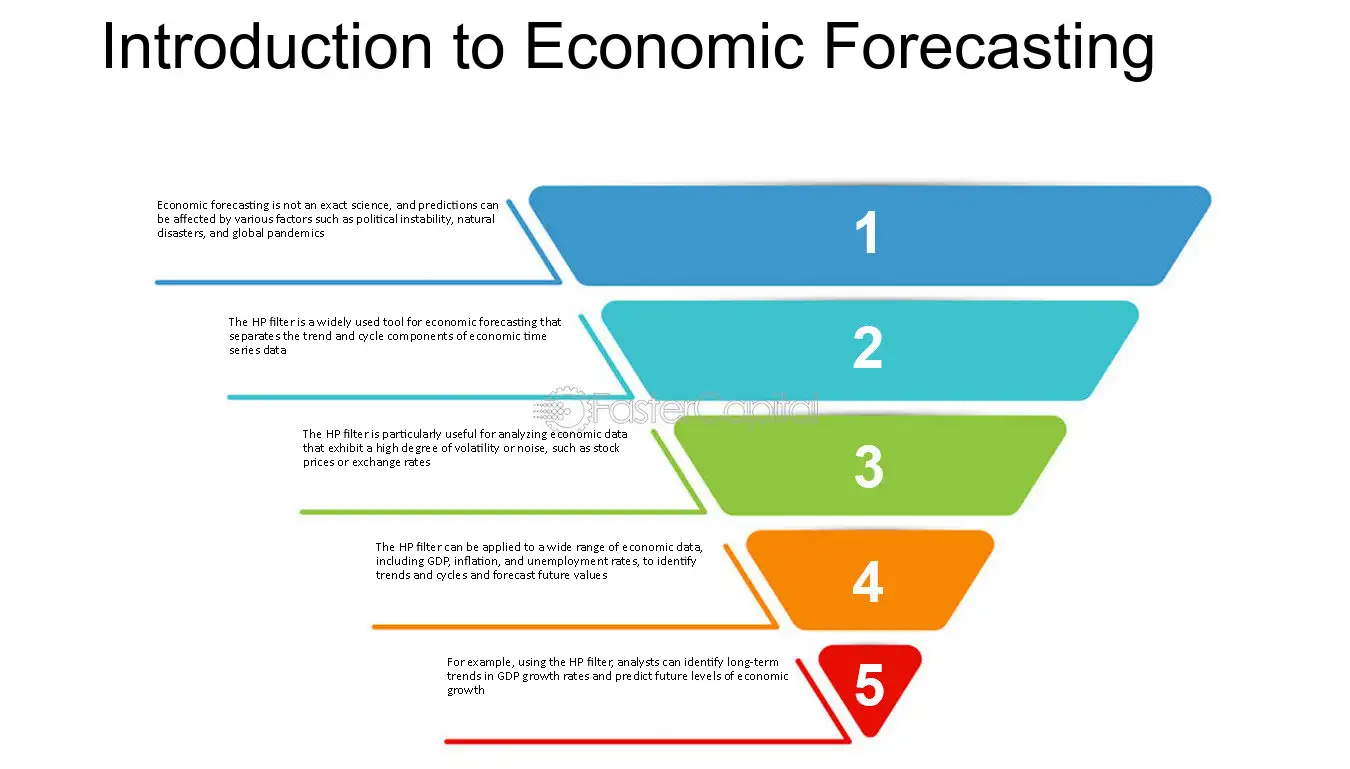

Photo: Economic Forecasting Methods Simplified

Economic Forecasting Methods Simplified: A Comprehensive Guide

Introduction

Economic forecasting plays a critical role in shaping policies, guiding business strategies, and supporting investment decisions. Whether predicting GDP growth, inflation rates, or employment trends, accurate forecasting is key to navigating uncertainty in a dynamic global economy. This article simplifies economic forecasting methods by exploring their types, how they work, and their real-world applications.

What is Economic Forecasting?

Economic forecasting is the process of making predictions about future economic conditions based on historical data and current trends. These forecasts help governments, corporations, and investors anticipate economic changes and make informed decisions. However, creating reliable economic predictions is no small task it requires complex models, statistical techniques, and a deep understanding of economic behavior.

Why is Economic Forecasting Important?

Accurate economic forecasts enable policymakers to implement timely interventions, helping stabilize economies during crises. For businesses, forecasts offer insights into future demand, pricing strategies, and potential risks. Additionally, investors rely on these predictions to adjust portfolios and maximize returns.

Without reliable forecasting, decision-makers would be left guessing, increasing the risk of financial loss and missed opportunities.

Types of Economic Forecasting Methods

To simplify the complex world of economic forecasting, we can categorize forecasting methods into two main types: quantitative and qualitative approaches.

1. Quantitative Methods

Quantitative methods rely on numerical data and statistical models to generate forecasts. These methods are highly data-driven and objective, making them suitable for environments with abundant historical data.

a. Time Series Analysis

Time series analysis involves studying patterns in historical data over time to predict future values. Key techniques include:

- Moving Averages: Averages calculated over a specified period to smooth out short-term fluctuations.

- Exponential Smoothing: A weighted average method that gives more weight to recent observations.

- ARIMA (Auto-Regressive Integrated Moving Average): A more advanced model used for non-stationary data.

Use Case: Time series analysis is widely used for predicting stock prices, inflation rates, and consumer demand.

b. Econometric Models

Econometric models use statistical methods to test hypotheses and forecast economic outcomes based on relationships between variables. These models often incorporate equations that describe how different factors such as interest rates, unemployment, and consumer spending interact.

Example: The Phillips Curve, which models the relationship between unemployment and inflation.

c. Input-Output Models

Input-output models assess the flow of goods and services within an economy, helping predict the impact of changes in one sector on others. They are useful for understanding inter-industry dependencies.

2. Qualitative Methods

Qualitative methods depend on expert judgment, opinion surveys, and market sentiment rather than historical data. They are particularly useful when historical data is limited or when predicting significant structural changes.

a. Delphi Method

The Delphi method gathers insights from a panel of experts through multiple rounds of surveys. After each round, feedback is provided, and experts revise their predictions until a consensus is reached.

Use Case: The Delphi method is often used for long-term forecasts, such as predicting technological advancements or geopolitical shifts.

b. Scenario Analysis

Scenario analysis involves creating multiple plausible future scenarios based on different assumptions. This method helps organizations prepare for various potential outcomes, even those with low probability but high impact.

Example: Central banks use scenario analysis to assess the potential impact of extreme financial crises.

c. Market Research

Market research uses qualitative data from surveys, interviews, and focus groups to gauge consumer sentiment and predict demand trends. While not as precise as quantitative methods, it provides valuable insights into short-term market behavior.

Factors Influencing Forecast Accuracy

Economic forecasting, despite its rigor, is not foolproof. Numerous factors can affect forecast accuracy:

- Data Quality: Poor-quality or incomplete data can lead to inaccurate predictions.

- Model Assumptions: Many models rely on assumptions that may not hold true in real-world scenarios.

- External Shocks: Unpredictable events such as natural disasters, pandemics, or geopolitical conflicts can render even the most accurate forecasts obsolete.

- Behavioral Economics: Human behavior, often irrational and difficult to predict, can introduce significant uncertainty into economic models.

Applications of Economic Forecasting

Economic forecasting is applied in various fields to guide decision-making and strategy:

1. Government Policy

Governments use forecasts to design fiscal and monetary policies. For example, GDP and unemployment forecasts influence budget allocations and interest rate decisions.

2. Business Strategy

Businesses rely on economic forecasts to make critical decisions, such as expanding operations, entering new markets, or adjusting product pricing.

3. Financial Markets

Investors and financial institutions use forecasts to anticipate market trends, manage risk, and identify profitable opportunities.

Challenges and Limitations

While economic forecasting offers valuable insights, it has its limitations. Some of the key challenges include:

- Uncertainty: The future is inherently uncertain, and even the most advanced models cannot eliminate all risk.

- Biases: Expert judgment in qualitative methods can be biased, affecting the reliability of predictions.

- Complexity: Economic systems are highly complex, with numerous interdependent variables, making it difficult to capture all influencing factors in a single model.

Despite these challenges, continued advancements in data science, machine learning, and artificial intelligence are improving the accuracy and reliability of economic forecasts.

Conclusion

Economic forecasting methods, whether quantitative or qualitative, are essential tools for anticipating future trends and making informed decisions. By understanding the strengths and limitations of various methods, policymakers, businesses, and investors can better navigate economic uncertainties. While no forecast is ever 100% accurate, combining multiple approaches and continuously refining models can lead to more reliable predictions.

As the global economy evolves, so too will the tools and techniques used for forecasting. Staying informed about these advancements will be crucial for anyone involved in strategic decision-making.

For You

View AllUnderstand vocational education and how it prepares individuals for hands-on careers. Explore practical learning today!

Mia Wilson

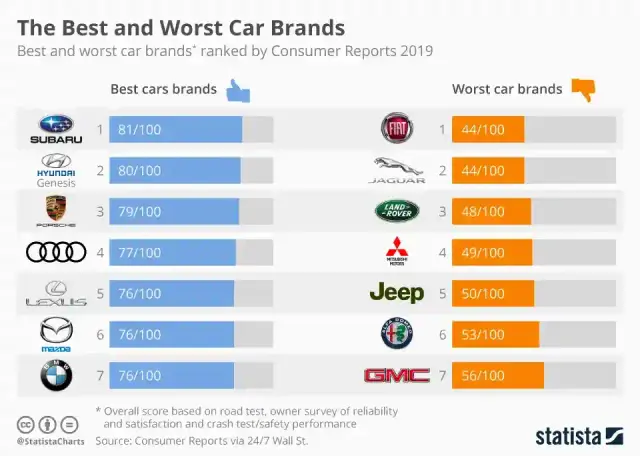

Discover the top performance car brands that dominate the market with speed, style, and innovation. Find your dream car now!

Mia Wilson

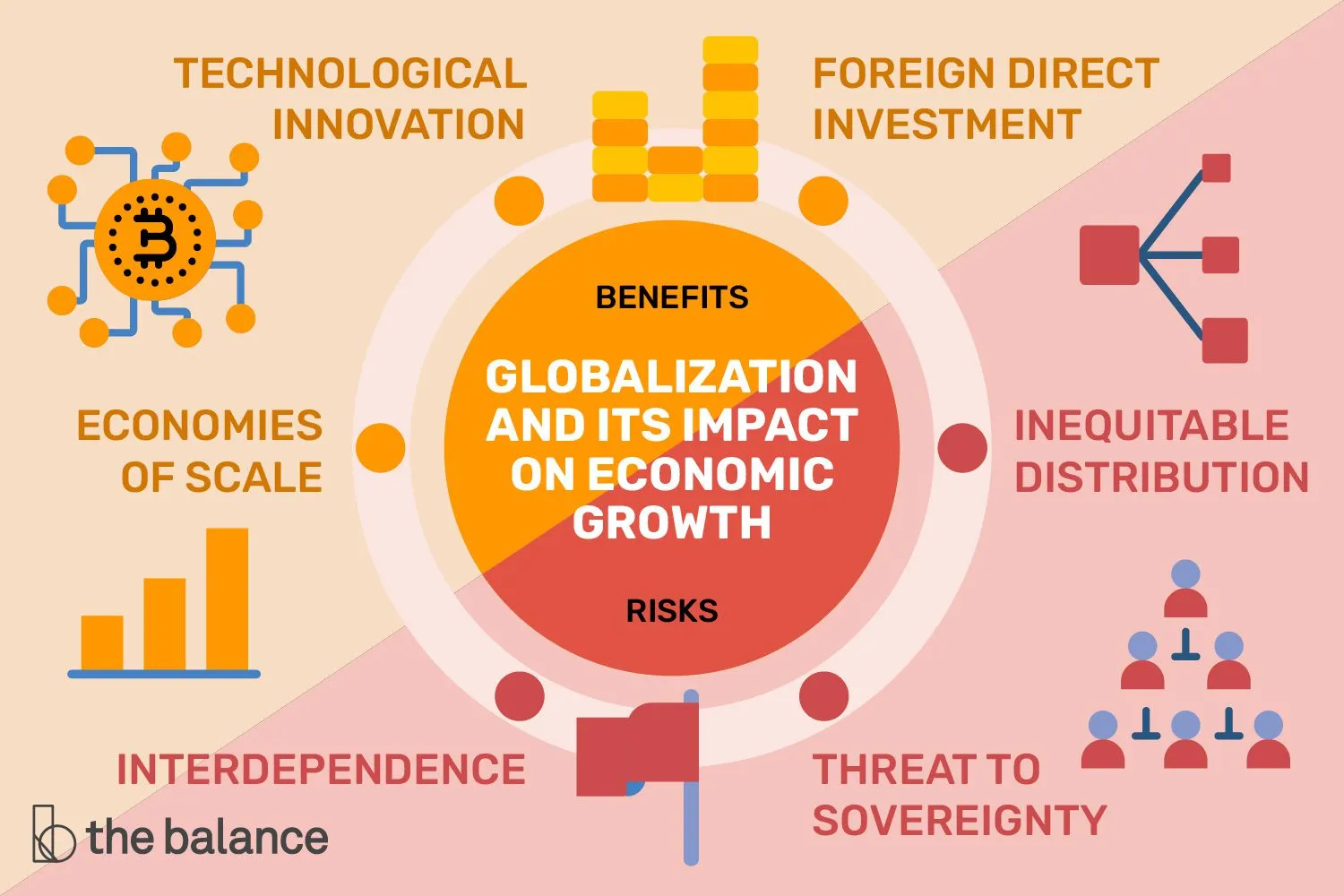

Learn how globalization impacts economies worldwide, from trade to employment. Click for a balanced analysis!

Mia Wilson

Discover educational psychology and how it enhances teaching and learning processes. Unlock better understanding today!

Mia Wilson

Compare run-flat tires with normal tires to see their pros, cons, and which is better for your driving needs. Learn more today!

Mia Wilson

Explore the latest blockchain trends and innovations shaping the digital future.

Mia Wilson

Education

View All

April 18, 2025

What Is Special Education?

Dive into special education, its purpose, and how it supports students with unique needs. Learn how it changes lives!

April 14, 2025

What Is Physical Education? Explained!

Discover the importance of physical education, its benefits, and why it's crucial for overall development. Learn more now!

April 25, 2025

Why Is Physical Education Important?

Learn why physical education is essential for health, academics, and personal growth. Get inspired to stay active!