How Does the Stock Market Work?

Mia Wilson

Photo: How Does the Stock Market Work?

How Does the Stock Market Work? A Comprehensive Guide

The stock market is one of the most fascinating and essential components of a modern economy. It provides a platform where businesses can raise capital, and investors can grow wealth by buying and selling shares. Despite its importance, the stock market can seem complicated to those unfamiliar with its workings. In this article, we’ll break down how the stock market works, why it matters, and how individuals can participate in it.

What Is the Stock Market?

The stock market refers to the collection of exchanges where stocks (shares of ownership in a company) are bought and sold. These exchanges facilitate the trading of equities, enabling companies to access capital for expansion and offering investors an opportunity to earn a return on their investment.

Major stock exchanges like the New York Stock Exchange (NYSE) and the Nasdaq are prominent platforms where most of this activity occurs. When someone refers to "the market," they are typically talking about these primary exchanges.

How the Stock Market Functions

The stock market operates based on the principles of supply and demand. When demand for a particular stock exceeds its supply, the stock price rises. Conversely, when supply exceeds demand, the price falls. This mechanism helps determine the fair market value of a company’s stock at any given time.

Here’s a simplified breakdown of how it works:

- Initial Public Offering (IPO):

A company enters the stock market by offering shares to the public for the first time through an IPO. This allows the company to raise capital while giving investors a stake in its future earnings. - Trading Stocks:

After the IPO, stocks can be traded on exchanges. Investors buy and sell shares through brokerage platforms, aiming to profit from price changes. Trades are executed electronically, and prices fluctuate constantly based on market sentiment, news, and financial performance. - Market Participants:

The market is composed of various participants, including retail investors, institutional investors (like mutual funds and hedge funds), and market makers who facilitate liquidity by continuously buying and selling shares. - Stock Indices:

Indices such as the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite track the performance of a selected group of stocks, offering a snapshot of the overall market’s health. When indices rise, it generally indicates investor confidence and economic growth, while declines can signal the opposite.

Key Factors Influencing the Stock Market

Several factors influence stock market movements. Understanding these can help investors make informed decisions:

1. Economic Indicators

Macroeconomic data such as GDP growth, unemployment rates, and inflation play a significant role in shaping market sentiment. Positive economic indicators can boost investor confidence, driving up stock prices, while negative data can trigger sell-offs.

2. Corporate Performance

Companies report earnings quarterly, and their performance relative to expectations can lead to significant price swings. Strong earnings reports often lead to stock price increases, while poor results can lead to declines.

3. Interest Rates

Interest rate changes by central banks, such as the Federal Reserve, directly impact borrowing costs for companies. When interest rates rise, borrowing becomes more expensive, potentially slowing growth and reducing stock valuations.

4. Geopolitical Events

Events like elections, trade tensions, and conflicts can cause market volatility. Investors closely watch global developments to anticipate potential impacts on their investments.

Why Do People Invest in the Stock Market?

Investing in the stock market offers several potential benefits:

1. Wealth Creation

Historically, the stock market has provided higher returns compared to other investment options, such as bonds or savings accounts. Long-term investors can benefit from the compounding effect, where reinvested earnings generate additional returns.

2. Dividend Income

Some companies pay dividends, which are regular payments to shareholders from profits. Dividend-paying stocks provide investors with a steady income stream in addition to potential capital appreciation.

3. Portfolio Diversification

Investing in different stocks and sectors helps reduce risk. If one sector underperforms, gains in another can offset the loss. Diversification is a key strategy for long-term investment success.

4. Ownership in Companies

Buying stocks means owning a piece of a company. Shareholders have voting rights and can participate in major corporate decisions.

How to Start Investing in the Stock Market

For beginners, investing in the stock market can be daunting. However, following these steps can help simplify the process:

1. Set Investment Goals

Determine your financial objectives whether it's saving for retirement, buying a house, or funding education. Clear goals guide your investment strategy.

2. Build an Emergency Fund

Before investing, ensure you have an emergency fund covering 3-6 months of expenses. This acts as a financial cushion in case of unexpected events.

3. Choose a Brokerage Account

Open a brokerage account with a reputable platform. Many brokers offer low fees, user-friendly interfaces, and educational resources for new investors.

4. Start with Low-Cost Index Funds

Index funds or exchange-traded funds (ETFs) track major indices and offer diversification at a low cost. These are ideal for beginners looking for broad market exposure.

5. Stay Informed

Keep up with financial news, earnings reports, and market trends. Continuous learning helps you make better investment decisions over time.

Risks of Stock Market Investing

While the stock market offers opportunities for wealth creation, it also comes with risks:

- Market Volatility:

Prices can fluctuate widely due to various factors, leading to potential losses in the short term. - Economic Downturns:

Recessions and financial crises can lead to prolonged periods of market decline. - Company-Specific Risks:

Poor management, scandals, or product failures can negatively impact a company’s stock price. - Emotional Investing:

Acting on fear or greed often leads to poor investment decisions. Successful investors stay disciplined and focus on long-term goals.

Conclusion: Mastering the Basics of the Stock Market

Understanding how the stock market works is crucial for anyone looking to grow their wealth through investing. While it may seem complex at first, breaking down the process into manageable steps can make it more approachable. The stock market is driven by supply and demand, influenced by various factors like economic data, corporate performance, and global events.

By learning the fundamentals, setting clear investment goals, and staying informed, individuals can participate in the market confidently. Whether you’re a beginner or a seasoned investor, continuous education and a disciplined approach are key to long-term success.

For You

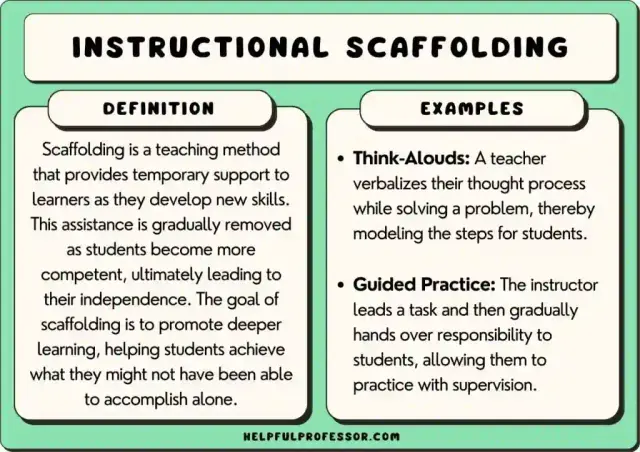

View AllDiscover scaffolding in education, its methods, and how it supports student success. Learn effective strategies now!

Mia Wilson

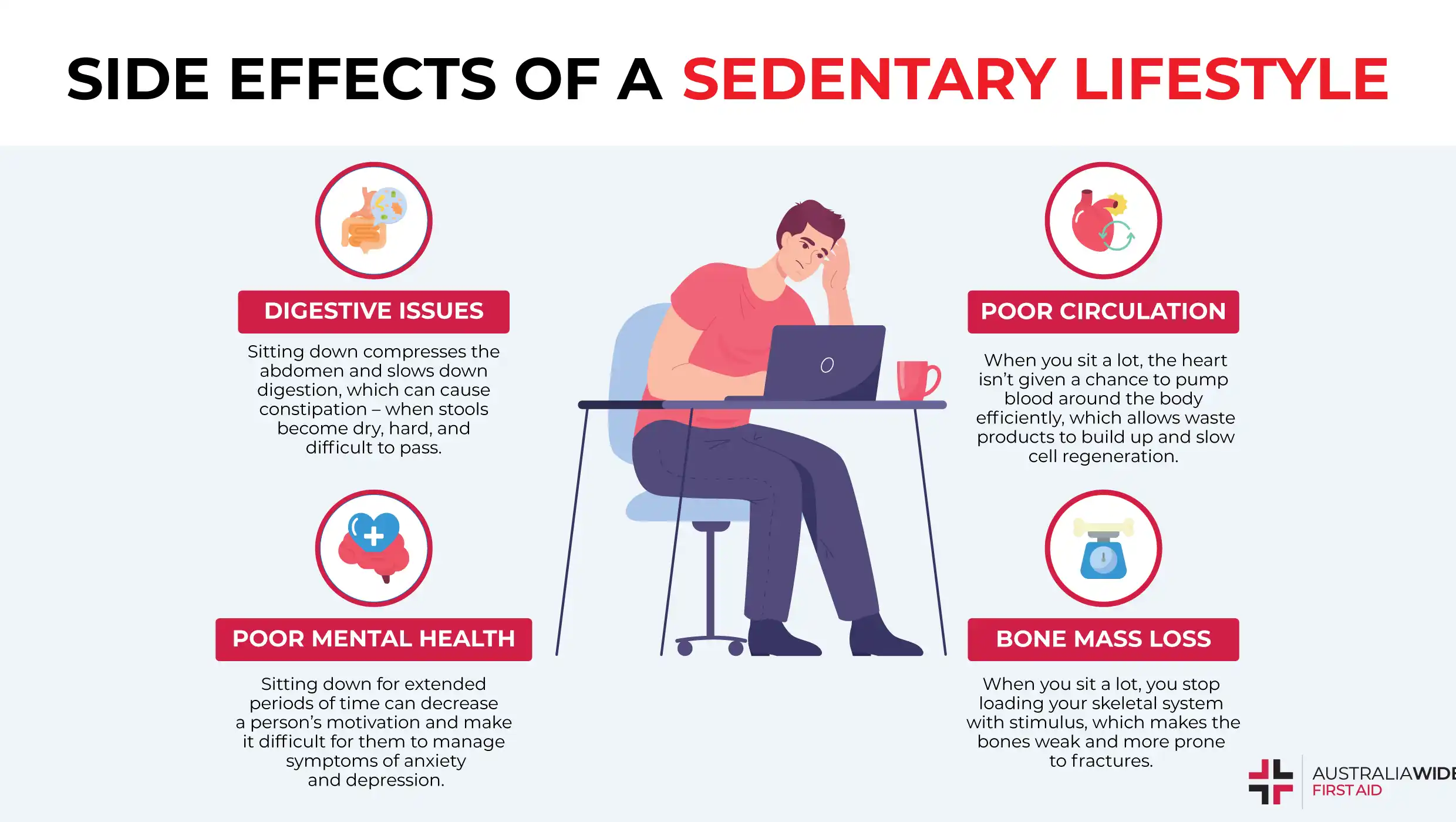

Uncover the dangers of prolonged inactivity on your health. Learn how to stay active and prevent health risks. Read more now!

Mia Wilson

Discover top fleet management practices to enhance efficiency and reduce costs. Optimize your fleet operations today!

Mia Wilson

Unveil 7 hidden adventure destinations perfect for thrill-seekers. Escape the ordinary and discover your next great adventure.

Mia Wilson

See how AI is changing the way we learn and teach in classrooms worldwide.

Mia Wilson

Avoid these common travel itinerary mistakes to ensure your trip goes smoothly. Learn expert tips for flawless planning!

Mia Wilson

Health

Education

View All

April 18, 2025

What Is Special Education?

Dive into special education, its purpose, and how it supports students with unique needs. Learn how it changes lives!

May 20, 2025

What Is Health Education?

Discover the importance of health education in promoting wellness and preventing diseases. Start your journey to health today!

May 3, 2025

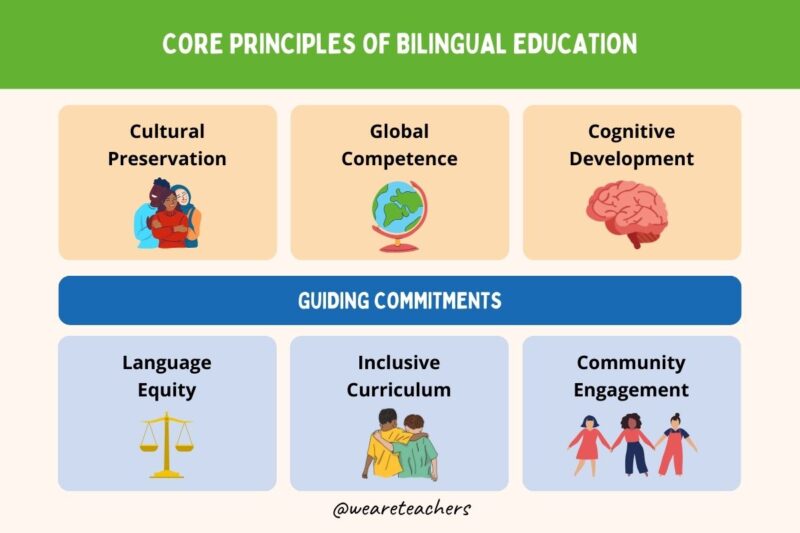

What Is Bilingual Education?

Explore bilingual education, its benefits, and how it fosters cultural understanding and cognitive growth. Learn more!