Monetary Policy Explained Simply

Mia Wilson

Photo: Monetary Policy Explained Simply

Monetary Policy Explained Simply: How It Affects Everyday Life

Monetary policy is a term often heard in news reports and economic discussions, but for many people, its meaning remains unclear. In essence, monetary policy refers to the strategies used by a country's central bank to manage the economy by controlling the money supply, interest rates, and inflation. Understanding monetary policy is crucial because it directly impacts employment rates, consumer prices, and the overall economic stability of a nation. This article breaks down the concept in simple terms, providing a comprehensive look at how it works and why it matters to everyone.

What Is Monetary Policy?

Monetary policy is a set of actions taken by a central bank such as the Federal Reserve in the United States or the European Central Bank (ECB) in Europe to regulate the supply of money and credit in an economy. The central bank’s main objective is to maintain price stability, promote high employment, and ensure moderate long-term interest rates.

There are two primary types of monetary policy:

- Expansionary Monetary Policy

This approach is used when an economy is slowing down or in recession. The central bank increases the money supply and lowers interest rates to encourage borrowing and investment, stimulating economic activity. - Contractionary Monetary Policy

This is applied when an economy is overheating, meaning inflation is rising too quickly. The central bank reduces the money supply and raises interest rates to cool down spending and bring inflation under control.

Key Tools of Monetary Policy

Central banks use several tools to implement monetary policy effectively. The primary methods include:

1. Open Market Operations (OMO)

Open market operations involve buying or selling government securities in the open market. When a central bank buys securities, it injects money into the economy, increasing liquidity. Conversely, selling securities reduces the money supply.

2. Interest Rate Adjustments

Interest rates are perhaps the most recognizable tool of monetary policy. By lowering or raising the benchmark interest rate (such as the federal funds rate in the U.S.), central banks influence borrowing costs. Lower rates make borrowing cheaper, encouraging businesses and consumers to spend, while higher rates discourage borrowing and spending.

3. Reserve Requirements

Reserve requirements refer to the amount of money banks must hold in reserve and not lend out. By adjusting these requirements, central banks can influence how much money banks can lend, affecting the overall money supply.

4. Quantitative Easing (QE)

Quantitative easing is a more unconventional tool used in situations where traditional methods may not be effective, such as during a financial crisis. It involves the central bank purchasing long-term assets to increase the money supply and lower long-term interest rates.

How Monetary Policy Impacts Everyday Life

Monetary policy has far-reaching effects on various aspects of everyday life, including:

1. Employment Opportunities

When central banks adopt an expansionary policy, lower interest rates make it easier for businesses to borrow money and invest in expansion. This often leads to job creation and reduced unemployment rates. Conversely, during contractionary periods, businesses may reduce hiring due to higher borrowing costs.

2. Inflation and Purchasing Power

Inflation the general rise in prices over time is closely linked to monetary policy. If the central bank allows too much money to circulate in the economy, inflation may rise, reducing the purchasing power of consumers. On the other hand, overly tight monetary policy can lead to deflation, where prices fall, potentially causing economic stagnation.

3. Loan and Mortgage Costs

Interest rate adjustments directly affect loan and mortgage costs. When rates are low, consumers can borrow at lower costs, making it easier to finance major purchases such as homes and cars. However, when rates are high, borrowing becomes more expensive, potentially dampening consumer spending.

4. Investment Returns

Monetary policy also impacts financial markets. Lower interest rates typically lead to higher stock prices, as companies find it cheaper to finance growth. In contrast, higher interest rates may cause stock prices to fall but can increase returns on savings and fixed-income investments.

Challenges in Implementing Monetary Policy

Despite its importance, monetary policy is not without challenges. Central banks must balance multiple objectives, such as controlling inflation while supporting employment. Additionally, there is often a time lag between implementing a policy and seeing its effects in the economy. Policymakers must also contend with external factors, such as global economic events, which can complicate the impact of domestic policy decisions.

One of the most debated challenges is how central banks should respond during periods of stagflation a situation where inflation is high, but economic growth is stagnant. Traditional monetary tools may be less effective in such scenarios, requiring innovative approaches.

Monetary Policy vs. Fiscal Policy

While monetary policy is managed by a central bank, fiscal policy refers to government decisions on taxation and public spending. Both policies aim to influence economic performance, but they work in different ways. Fiscal policy directly affects demand by increasing or decreasing government spending, whereas monetary policy indirectly influences demand by altering the cost and availability of money.

During a severe economic downturn, central banks and governments often coordinate their efforts. For example, during the 2008 financial crisis and the COVID-19 pandemic, central banks implemented aggressive monetary easing, while governments introduced stimulus packages to support businesses and households.

Conclusion: Why Understanding Monetary Policy Matters

Monetary policy may seem like an abstract concept, but its effects are tangible in everyday life. It influences everything from the prices of groceries and gas to the availability of jobs and the cost of borrowing. By understanding how monetary policy works, individuals can make more informed financial decisions, whether it's choosing the right time to take out a loan or deciding how to invest their savings.

Moreover, staying informed about monetary policy helps citizens better understand economic news and participate in discussions about national economic strategies. As central banks continue to navigate complex economic landscapes, understanding the basics of monetary policy is more important than ever.

For more insights on economic topics, check out related articles on Economic Fundamentals and Understanding Inflation.

For You

View AllLearn how blockchain is powering the NFT market and what it means for creators.

Mia Wilson

Learn about secondary education, its structure, and its role in shaping academic and career paths. Get insights today!

Mia Wilson

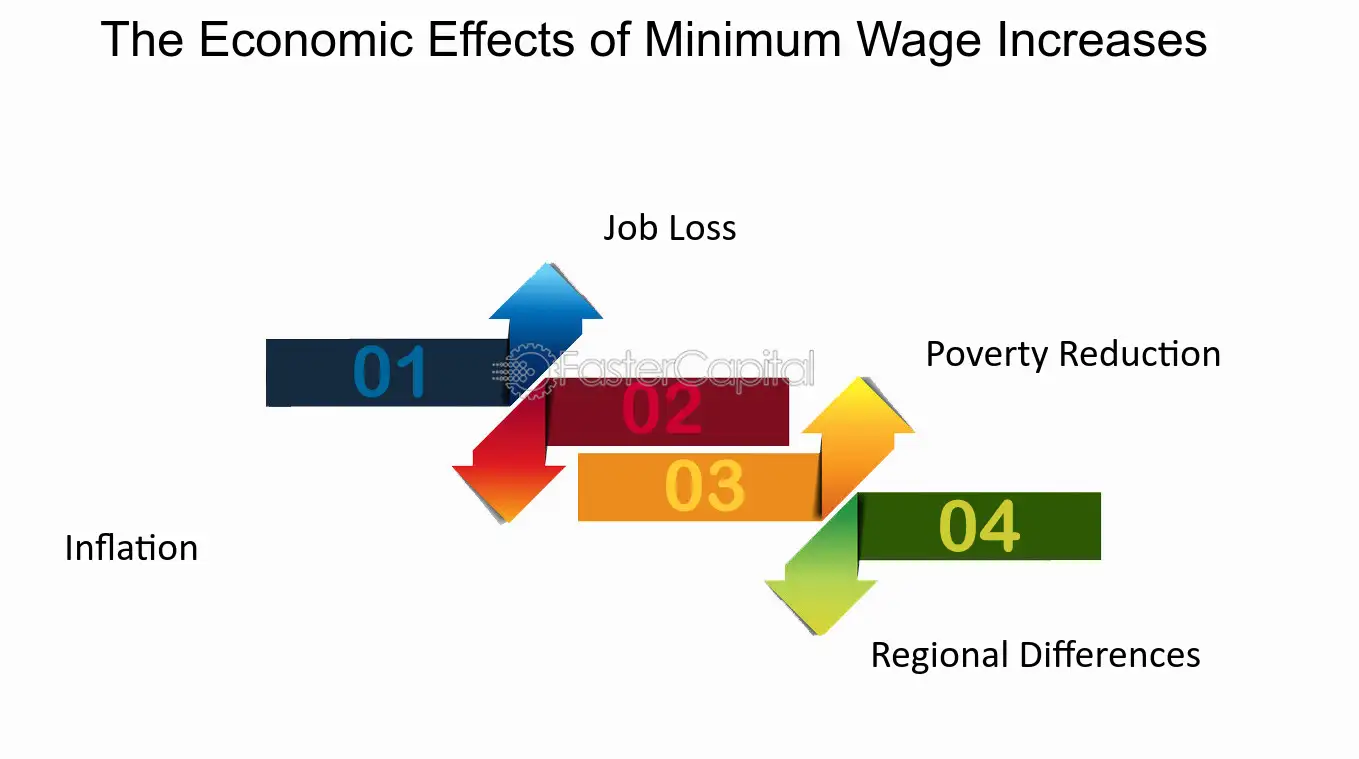

Discover how changes in the minimum wage affect the economy, businesses, and workers. Click to explore the pros and cons!

Mia Wilson

Explore Europe with this 7-day travel itinerary. Discover must-see destinations, activities, and tips for a hassle-free European adventure!

Mia Wilson

Explore expert opinions on whether AI will take over human jobs in the future.

Mia Wilson

Debunk common myths about AI and understand its real capabilities.

Mia Wilson

Education

View All

April 17, 2025

What Is Secondary Education? Explained!

Learn about secondary education, its structure, and its role in shaping academic and career paths. Get insights today!

April 26, 2025

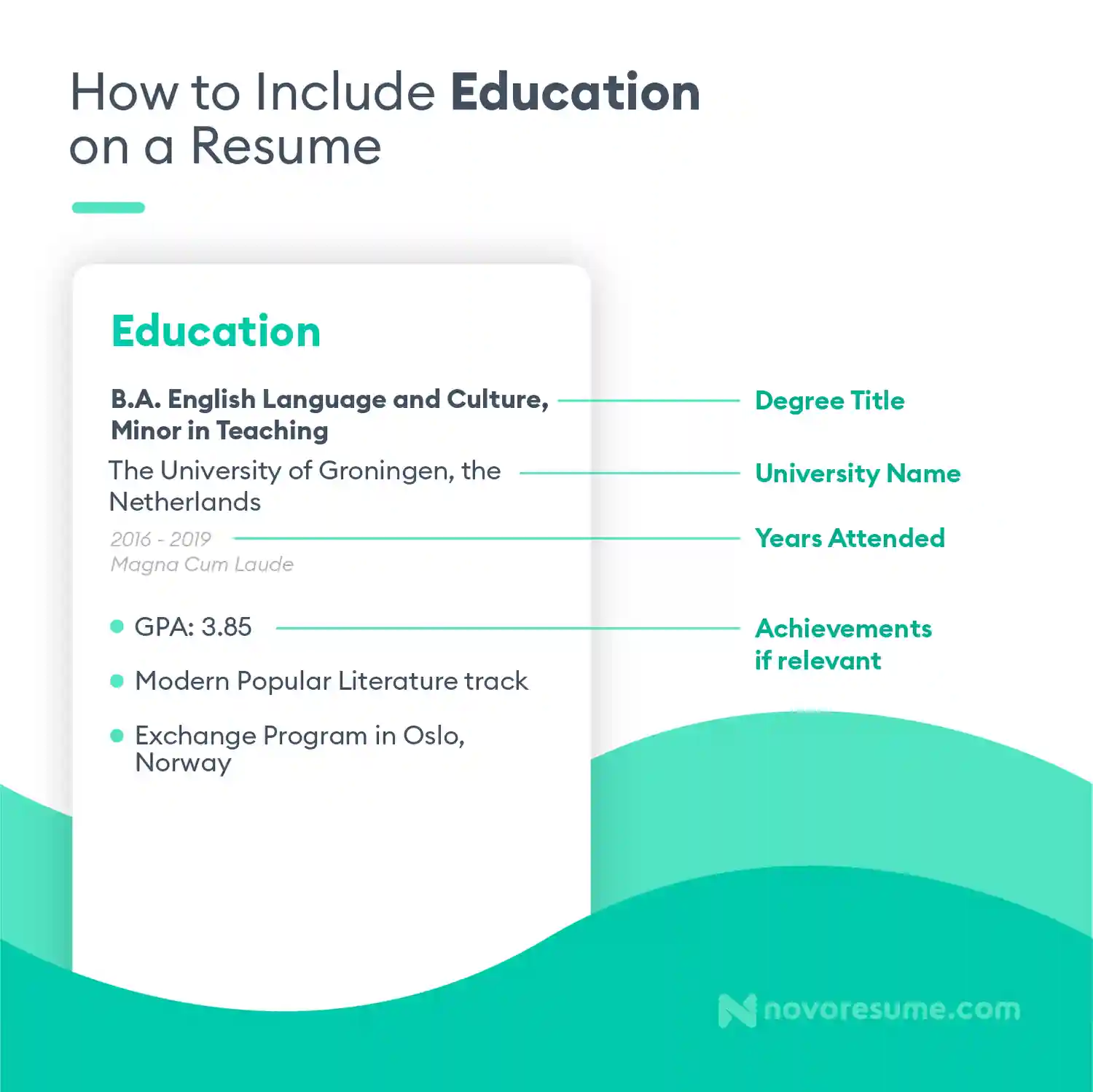

How to List Education on Your Resume

Discover the best ways to showcase your education on a resume for maximum impact. Land your dream job now!

April 14, 2025

What Is Post-Secondary Education?

Understand post-secondary education, its types, and how it shapes careers. Start exploring your opportunities today!