Step-by-Step Guide to Refinancing Your Home Loan Online

Mia Wilson

Photo: Step-by-Step Guide to Refinancing Your Home Loan Online

Introduction to Home Loan Refinancing

Home loan refinancing is a financial strategy that enables homeowners to replace their existing mortgage with a new one, typically under different terms. This process can be motivated by various factors, including the desire to benefit from lower interest rates, reduce monthly payments, or access home equity for other uses, such as home improvements or debt consolidation. Understanding the nuances of refinancing is crucial for homeowners contemplating this option, as the right decision can lead to significant long-term savings and financial flexibility.

One of the most compelling reasons for refinancing is the potential for lowering the interest rate on your mortgage. If market rates have decreased since you took out your original loan, refinancing can enable you to secure a better rate that reduces your monthly payment. This reduction in payment can provide breathing room in your monthly budget, allowing for increased savings or reallocation of funds towards other financial goals.

Additionally, homeowners may consider refinancing to modify the duration of their loan. For instance, transitioning from a 30-year mortgage to a 15-year term can help favorably adjust interest costs over time, even while increasing monthly payments. On the other hand, extending the term of the loan may provide valuable short-term relief during financially challenging times.

Accessing home equity is another significant motive for homeowners to refinance. By borrowing against the increased value of your home, you can leverage the equity accrued over time for various purposes such as funding education, investing, or making necessary home renovations. This form of refinancing offers a strategic avenue for utilizing asset appreciation even with an outstanding mortgage.

Ultimately, comprehending the intricacies of home loan refinancing can empower homeowners to make informed decisions that align with their financial objectives.

Understanding Your Current Mortgage Situation

Before embarking on the journey to refinance your home loan online, it is essential to evaluate your existing mortgage situation critically. Analyzing key elements such as current interest rates, loan terms, and remaining balance will provide valuable insights into your eligibility for refinancing and help establish whether it is the right time to proceed.

Start by reviewing the interest rate on your current mortgage. Compare it to the prevailing rates in the market. If the current rates are significantly lower than what you are presently paying, this discrepancy could present a favorable opportunity to refinance. Additionally, understanding the terms of your existing loan is crucial. Take note of the length of your loan, whether you have a fixed or adjustable-rate mortgage, and any associated fees that may affect potential savings through refinancing.

The remaining balance on your mortgage is another critical factor that must be carefully assessed. A lower balance might indicate that you are closer to owning your home outright, making it potentially advantageous to refinance for a better rate or shorter term even more appealing in this context.

Gathering necessary documents is a fundamental part of this process. You will need to compile financial information, including recent pay stubs, tax returns, bank statements, and details about your existing mortgage. Organizing these documents in advance will contribute to a smoother refinancing experience.

Lastly, consider calculating potential savings from refinancing. Utilize online calculators to project how different interest rates and loan terms will impact your monthly payments and total interest expenses over time. This analysis will help you make informed decisions regarding the refinancing process and ensure that you pursue options that are both financially viable and beneficial.

Researching Your Refinancing Options

When considering refinancing your home loan online, it is crucial to undertake comprehensive research to identify the most suitable options available to you. Various refinancing types cater to different financial needs, so understanding these options will help you make an informed decision. The primary categories of refinancing include cash-out refinancing, rate-and-term refinancing, and streamline refinancing. Each type serves distinct purposes and can significantly impact your financial trajectory.

Cash-out refinancing allows homeowners to extract equity from their property, converting it into cash. This option can be beneficial if you have substantial equity and wish to fund major expenses like home renovations or debt consolidation. In contrast, rate-and-term refinancing is focused primarily on altering the existing loan terms or securing a lower interest rate, which can result in reduced monthly payments or a shorter loan duration. Lastly, streamline refinancing simplifies the process, usually with fewer requirements, providing a fast and efficient way for borrowers to secure better rates without extensive documentation.

When researching potential lenders, it is vital to compare multiple options to find the best refinancing deal. Start by gathering information on the lenders’ rates, terms, and the loan products they offer. Make sure to understand any associated fees, including origination fees, appraisal charges, and closing costs, as these can significantly affect the overall affordability of the refinance. Reading reviews and testimonials from other borrowers can provide insight into their experiences with various lenders and help you gauge their reliability.

It is also essential to remain cautious of offers that appear too good to be true. Sometimes, lenders may advertise unreasonably low rates or terms to attract customers but may later impose hidden fees. A thorough investigation of each option, accompanied by an awareness of the potential pitfalls, will enhance your chances of securing a beneficial refinancing deal.

Preparing Your Financial Profile

Refinancing your home loan online begins with a thorough preparation of your financial profile. This step is crucial, as lenders will scrutinize various aspects of your financial situation to determine your eligibility for refinancing and to establish the interest rates they are willing to offer.

First and foremost, your credit score is a critical component of your financial profile. It acts as a reflection of your creditworthiness and significantly affects the loan approval process and interest rates. Generally, a higher credit score can lead to more favorable terms and lower rates, ultimately saving you money over the life of the loan. To prepare, it is advisable to check your credit report for errors and take corrective actions if necessary. In addition, consider paying down existing debts to improve your score prior to applying for refinancing.

Another essential factor is your debt-to-income (DTI) ratio, which compares your monthly debt payments to your gross monthly income. Lenders use this metric to assess your ability to manage monthly payments and repay borrowed funds. A lower DTI ratio is favorable, typically below 43%, as it indicates that you have a manageable level of debt relative to your income. To optimize your DTI, you may want to reduce your overall debt before refinancing, which will subsequently boost your loan application.

Lastly, gathering necessary documentation is vital for a smooth refinancing process. Key documents include recent tax returns, pay stubs, and bank statements. These pieces of information provide lenders with a comprehensive view of your financial situation, aiding in the assessment of your application. Being prepared and organized with these documents can expedite the refinancing process and lead to a successful outcome.

Application Process for Refinancing Online

Refinancing a home loan online has become an increasingly efficient and convenient option for homeowners seeking better mortgage rates or terms. To begin the application process, you first need to select a lender that offers online refinancing services. Research different lenders to compare rates, fees, and customer reviews to find the best fit for your refinancing needs.

Once you have chosen a lender, the application process typically starts with filling out an online application form. This form will require essential information such as your personal details, contact information, Social Security number, and employment history. Additionally, you will need to provide details about your current mortgage, including the loan amount, balance, and monthly payment. It is crucial to supply accurate information to avoid potential delays in processing your application.

Moreover, most lenders will request documentation to verify your income and assets, which may include pay stubs, W-2 forms, tax returns, and bank statements. Ensure you have these documents readily available, as they will facilitate a smoother application process. Some lenders may also require additional information, such as a description of your current home and details regarding your credit history. Keep in mind that having a good credit score can significantly influence the terms of your refinance.

When considering multiple applications, it’s important to note that each lender will perform a hard inquiry on your credit report, which can temporarily affect your credit score. However, most credit scoring models allow for rate shopping when applications are made in a short time frame, typically within 30 days. This means that numerous inquiries within this period are often treated as a single inquiry, minimizing the impact on your overall credit score.

Understanding the Underwriting Process

The underwriting process is a critical phase in refinancing your home loan and involves a thorough evaluation of your financial information and property. During this step, underwriters assess the risk associated with lending money to you by analyzing various factors such as your credit score, employment history, income level, and existing debt. Additionally, they will review the appraisal report of your home to confirm its market value aligns with the loan amount you are seeking. This ensures the lender is making a sound investment.

Typically, the underwriting process can take anywhere from a few days to a few weeks. The duration largely depends on the complexity of your financial situation and the current workload of the underwriting team. To facilitate a faster process, it is advisable to promptly submit all requested documentation and be responsive to any inquiries. Being organized and transparent about your finances can significantly streamline this phase.

While undergoing underwriting, you might be asked for additional information. Common requests may include clarifying your employment details, providing bank statements, or documenting any large deposits. It is crucial to address these requests as swiftly as possible, as delays in providing this information can prolong the refinancing timeline and create unnecessary roadblocks.

The underwriting process, although sometimes daunting, serves as a safeguard for both the lender and the borrower. Understanding what underwriters look for and how to prepare can ease your anxiety and help prevent potential issues. By staying proactive and communicative, you can enhance the chances of a smooth refinancing experience, paving the way for favorable loan terms and conditions.

Closing the Refinance Deal

The closing phase of your home loan refinance is a critical point where all your preparations culminate. During this stage, borrowers should be prepared for a final review of documents, verification of terms, and the settlement of any outstanding fees. It is essential to carefully examine all documents prior to the closing meeting to ensure that they reflect the agreed-upon terms of your new loan.

One of the primary documents to review is the closing disclosure, which outlines the specifics of your mortgage. This includes the loan amount, interest rate, monthly payments, and any associated fees. Be vigilant in checking for discrepancies, as this document serves as the final blueprint of your refinancing agreement. Additionally, you should verify that the terms are consistent with what was discussed during the loan approval process.

In the days leading up to the closing meeting, you may encounter potential last-minute fees that could arise from various sources, such as increased appraisal fees or additional title insurance costs. These charges should have been disclosed to you earlier in the process, but it is prudent to confirm the final tally to avoid unexpected expenses. Reviewing your financial obligations at this juncture will ensure that you are fully prepared for the costs associated with the refinancing process.

Moreover, ahead of the closing meeting, it is advisable to prepare necessary documents, including identification and proof of homeownership. These materials will facilitate a smoother exchange during the closing. Finally, fostering a clear line of communication with your lender can aid in addressing any last-minute questions or discrepancies. By thoroughly understanding the final terms of your new mortgage and preparing adequately for the closing meeting, you can ensure a successful transition into your refinanced home loan.

Post-Refinancing Considerations

Upon successfully completing the refinancing process of your home loan, several important considerations come into play that can significantly impact your financial wellbeing. First and foremost, managing the new loan entails understanding its terms and conditions. Familiarize yourself with the interest rate, monthly payments, and any penalties for late payments or early repayment. This knowledge is crucial for budgeting and ensuring timely payments, which will ultimately contribute to your credit score over time. It is also advisable to set up automatic payments to avoid missing due dates.

Beyond managing your payments, it is wise to actively monitor interest rates in the market. Economic factors and changes in financial policies can result in fluctuations. If rates drop significantly after refinancing, it could create an opportunity for future refinancing. Staying informed about these changes enables you to reassess your situation and determine if another refinance could benefit you financially.

An essential aspect of the refinancing journey is evaluating how the new loan aligns with your long-term financial goals. Consider how it fits into your overall financial strategy, such as savings, investments, or even retirement planning. This assessment may require periodic reviews of your financial plan, taking into account changes in income, expenses, and life circumstances that may influence your housing needs.

Additionally, maintaining a strong communication channel with your lender can provide insights into any potential programs or benefits you may qualify for in the future. As you navigate the post-refinancing landscape, always keep an eye on ways to improve your financial standing while ensuring the mortgage serves its intended purpose, contributing positively to your financial freedom.

Frequently Asked Questions (FAQs)

Refinancing a home loan is a significant financial decision that often raises various questions. One of the most common concerns is regarding the equity required to refinance. Generally, lenders prefer homeowners to have at least 20% equity in their home to secure favorable refinancing terms. However, some lenders may accept lower equity percentages, although this could result in higher interest rates or the necessity of private mortgage insurance (PMI), which adds to monthly costs.

Another question frequently encountered pertains to whether refinancing is advisable if one is planning to move soon. In such cases, homeowners must weigh the costs associated with refinancing against the potential savings from a lower interest rate. If the homeowner plans to relocate within a year or two, the savings may not outweigh the upfront costs, such as closing fees and other charges. It is essential to calculate the break-even point how long it will take for the savings to exceed these costs before making a decision.

Improving one's credit score is also a pivotal concern for those preparing to refinance. A higher credit score can lead to better interest rates and loan terms. To enhance a credit score before applying for refinancing, individuals can take several steps, including paying off outstanding debts, making timely payments on existing loans, and ensuring that credit reports are free of inaccuracies. Regularly reviewing these reports can help identify aspects that may need correction or improvement.

Other common inquiries include the types of refinancing options available and how long the entire process takes. Homeowners can consider rate-and-term refinancing, cash-out refinancing, and streamline refinancing, depending on their financial goals. The time frame for completing a refinance can vary significantly, but it typically takes between 30 to 45 days from application to closing. By addressing these frequently asked questions, homeowners can feel more informed and prepared for the refinancing journey.

For You

View AllDiscover how crash tests are done and why they’re essential for vehicle safety. Explore the behind-the-scenes science now!

Mia Wilson

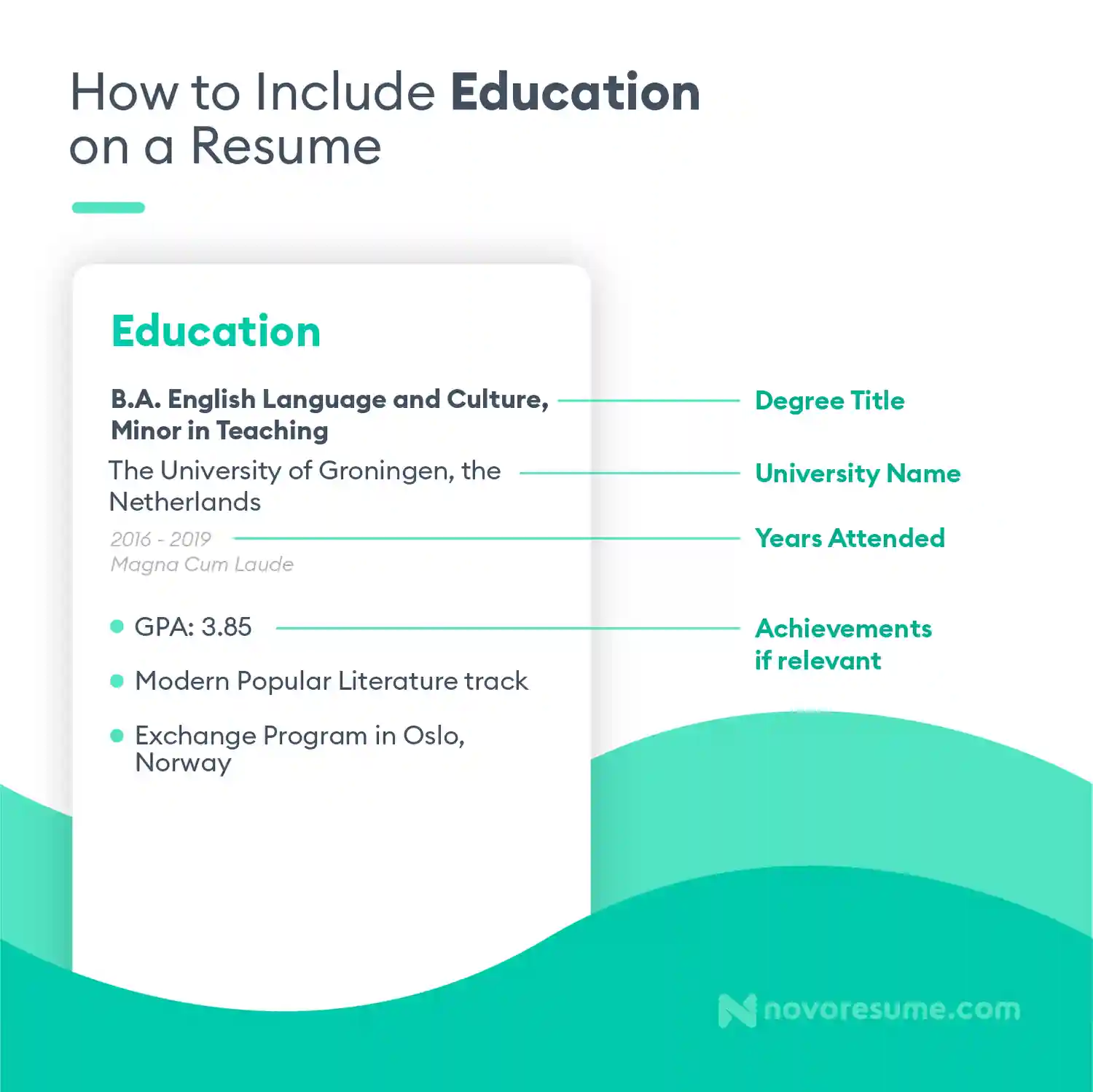

Discover the best ways to showcase your education on a resume for maximum impact. Land your dream job now!

Mia Wilson

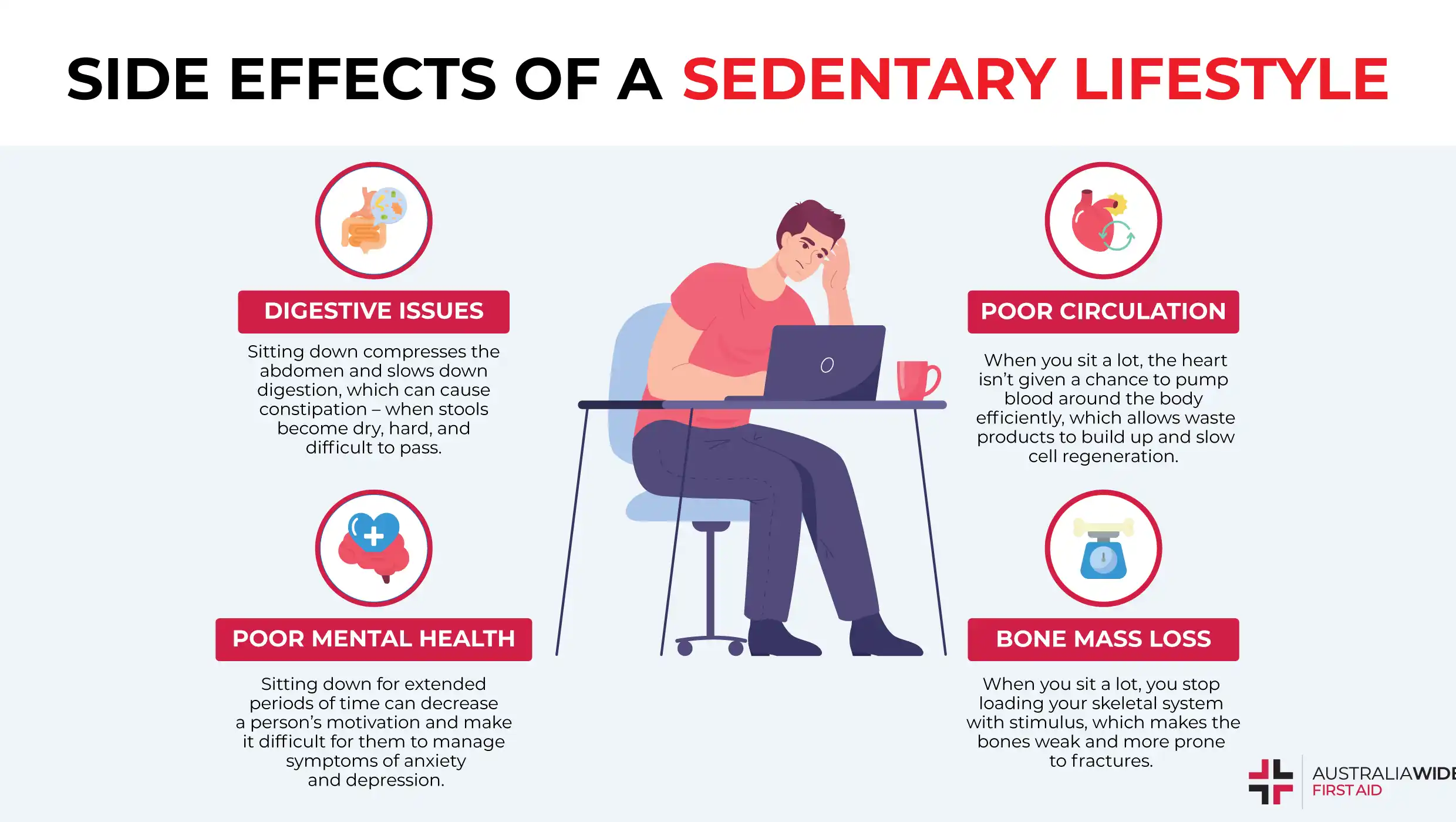

Uncover the dangers of prolonged inactivity on your health. Learn how to stay active and prevent health risks. Read more now!

Mia Wilson

Understand continuing education, its benefits, and how it boosts career growth and lifelong learning. Learn more!

Mia Wilson

Explore expert opinions on whether AI will take over human jobs in the future.

Mia Wilson

Learn what international trade is and why it’s essential for global economies. Click for an engaging overview!

Mia Wilson

Health

Education

View All

May 8, 2025

How Does Technology Affect Education?

Discover how technology is transforming education, enhancing access, and reshaping classrooms. Explore its impact now!

May 5, 2025

What Is General Education?

Learn what general education entails and its role in providing foundational knowledge for lifelong success. Start exploring today!

May 23, 2025

What Is Sex Education?

Explore the significance of sex education in schools and how it promotes informed and healthy choices. Learn why it matters!