Usage-Based Insurance Explained

Mia Wilson

Photo: Usage-Based Insurance Explained

Usage-Based Insurance Explained: A Comprehensive Guide

Meta Description: Discover how usage-based insurance works, its benefits, and how it can save you money. Learn the ins and outs of this modern insurance model.

Introduction

In the ever-evolving landscape of the insurance industry, traditional models are giving way to more personalized and flexible approaches. One such innovation is Usage-Based Insurance (UBI). Unlike conventional insurance policies that rely on broad demographic factors to determine premiums, UBI tailors rates based on individual behavior and actual usage. This shift not only offers potential savings for consumers but also provides insurers with more accurate risk assessments.

What is Usage-Based Insurance?

Defining Usage-Based Insurance

Usage-Based Insurance is a type of auto insurance that calculates premiums based on how, when, and how much you drive. By leveraging technology to monitor driving patterns, UBI provides a more personalized approach to insurance pricing. This model stands in contrast to traditional insurance, which often depends on static factors like age, gender, and driving history.

The Evolution of UBI

The concept of UBI isn't entirely new, but its widespread adoption has been facilitated by advancements in technology. Initially, insurance companies relied on self-reported data or periodic check-ins to adjust premiums. However, the integration of telematics devices, smartphone apps, and connected cars has revolutionized the way data is collected and analyzed, making UBI more feasible and accurate.

How Does Usage-Based Insurance Work?

Data Collection Methods

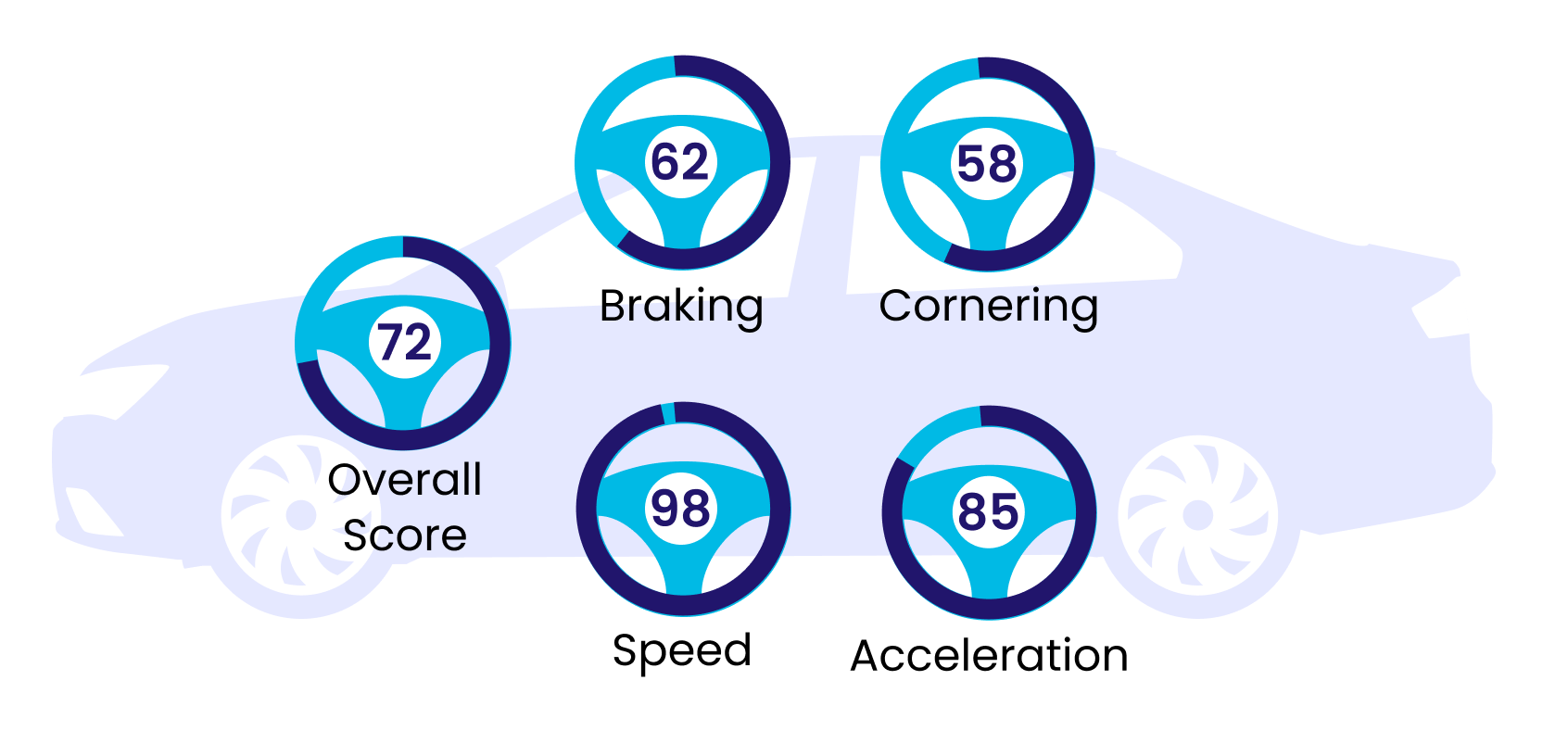

UBI programs gather data through various means, primarily focusing on driving behavior and vehicle usage. Common data points include:

- Mileage: Total distance driven within a specific period.

- Speed: Frequency of speeding or adherence to speed limits.

- Acceleration and Braking: Smoothness of driving maneuvers.

- Time of Day: Driving during peak hours versus off-peak times.

- Location: Areas where the vehicle is primarily driven.

Types of UBI Programs

There are generally two main types of UBI programs:

- Pay-As-You-Drive (PAYD): Premiums are based on the total miles driven. This is ideal for low-mileage drivers who may see significant savings.

- Pay-How-You-Drive (PHYD): Premiums are influenced by driving behaviors, such as safe acceleration, braking, and adherence to traffic rules. Safe drivers can benefit from lower premiums.

Implementation Tools

Insurers use telematics devices installed in vehicles or smartphone applications to collect and transmit data. These tools provide real-time insights into driving habits, allowing for continuous monitoring and more dynamic pricing models.

Benefits of Usage-Based Insurance

For Consumers

- Potential Cost Savings: Safe and low-mileage drivers can significantly reduce their insurance premiums.

- Personalized Rates: Insurance becomes more reflective of individual driving habits rather than broad demographics.

- Encouragement of Safe Driving: Real-time feedback can promote safer driving behaviors, potentially reducing accidents.

For Insurers

- Accurate Risk Assessment: Detailed data allows insurers to more precisely evaluate risk, leading to fairer pricing.

- Enhanced Customer Engagement: Interactive tools and personalized feedback can improve customer satisfaction and loyalty.

- Reduced Fraud: Continuous data monitoring helps in identifying and preventing fraudulent claims.

Potential Drawbacks and Considerations

Privacy Concerns

One of the primary concerns with UBI is the collection and handling of personal driving data. Consumers may worry about how their information is used, stored, and shared. It's crucial for insurers to maintain transparency and robust data security measures to address these concerns.

Data Security

With the increasing reliance on digital data, the risk of data breaches becomes a significant issue. Insurers must invest in strong cybersecurity protocols to protect sensitive information from unauthorized access and cyber threats.

Premium Variability

While many drivers stand to benefit from lower premiums, others may experience higher costs if their driving behavior is deemed risky. This variability can be a deterrent for some consumers who prefer the predictability of traditional insurance models.

Market Trends and Adoption Rates

Growing Popularity of UBI

The adoption of usage-based insurance has been steadily increasing, driven by the proliferation of connected devices and the demand for more personalized insurance solutions. According to recent studies, a significant percentage of new auto insurance policies now incorporate UBI elements, reflecting its growing acceptance in the market.

Technological Advancements

Innovations in telematics and data analytics are enhancing the capabilities of UBI programs. Advanced algorithms and machine learning are enabling more sophisticated analysis of driving data, leading to even more accurate premium calculations and risk assessments.

Regulatory Environment

As UBI becomes more prevalent, regulatory frameworks are evolving to address issues related to data privacy, consumer protection, and fair pricing practices. Insurers must navigate these regulations carefully to ensure compliance and maintain consumer trust.

Critical Insights and Future Outlook

Balancing Personalization and Privacy

The future of UBI hinges on finding the right balance between personalized insurance and the protection of consumer privacy. Insurers that prioritize transparent data practices and robust security measures are likely to gain a competitive edge and foster greater trust among consumers.

Integration with Emerging Technologies

The integration of UBI with emerging technologies, such as autonomous vehicles and the Internet of Things (IoT), presents new opportunities and challenges. As vehicles become more connected and intelligent, the scope of data collection and analysis will expand, potentially leading to even more refined insurance models.

Sustainability and Environmental Impact

UBI has the potential to contribute to environmental sustainability by encouraging efficient driving habits and reducing unnecessary mileage. Insurers can play a pivotal role in promoting eco-friendly driving behaviors, aligning with broader societal goals of reducing carbon emissions and conserving resources.

Conclusion

Usage-Based Insurance represents a significant shift in the insurance industry, offering a more personalized and data-driven approach to auto insurance. By leveraging technology to monitor driving behavior and vehicle usage, UBI provides benefits for both consumers and insurers, including potential cost savings, accurate risk assessments, and enhanced customer engagement. However, it also presents challenges related to privacy, data security, and premium variability that must be carefully managed.

As technology continues to advance and the market for UBI expands, it is likely that usage-based insurance will become an increasingly common choice for drivers seeking tailored insurance solutions. The future of UBI will depend on the industry's ability to balance personalization with privacy, integrate emerging technologies, and contribute to broader sustainability goals. For drivers considering UBI, understanding how it works and evaluating its benefits and drawbacks is essential in making informed insurance decisions.

For You

View AllLearn the online car buying process and how to secure the best deals with ease. Get expert tips for a safe and smart purchase!

Mia Wilson

Unpack the meaning of education, its significance, and its role in transforming lives. Explore its essence today!

Mia Wilson

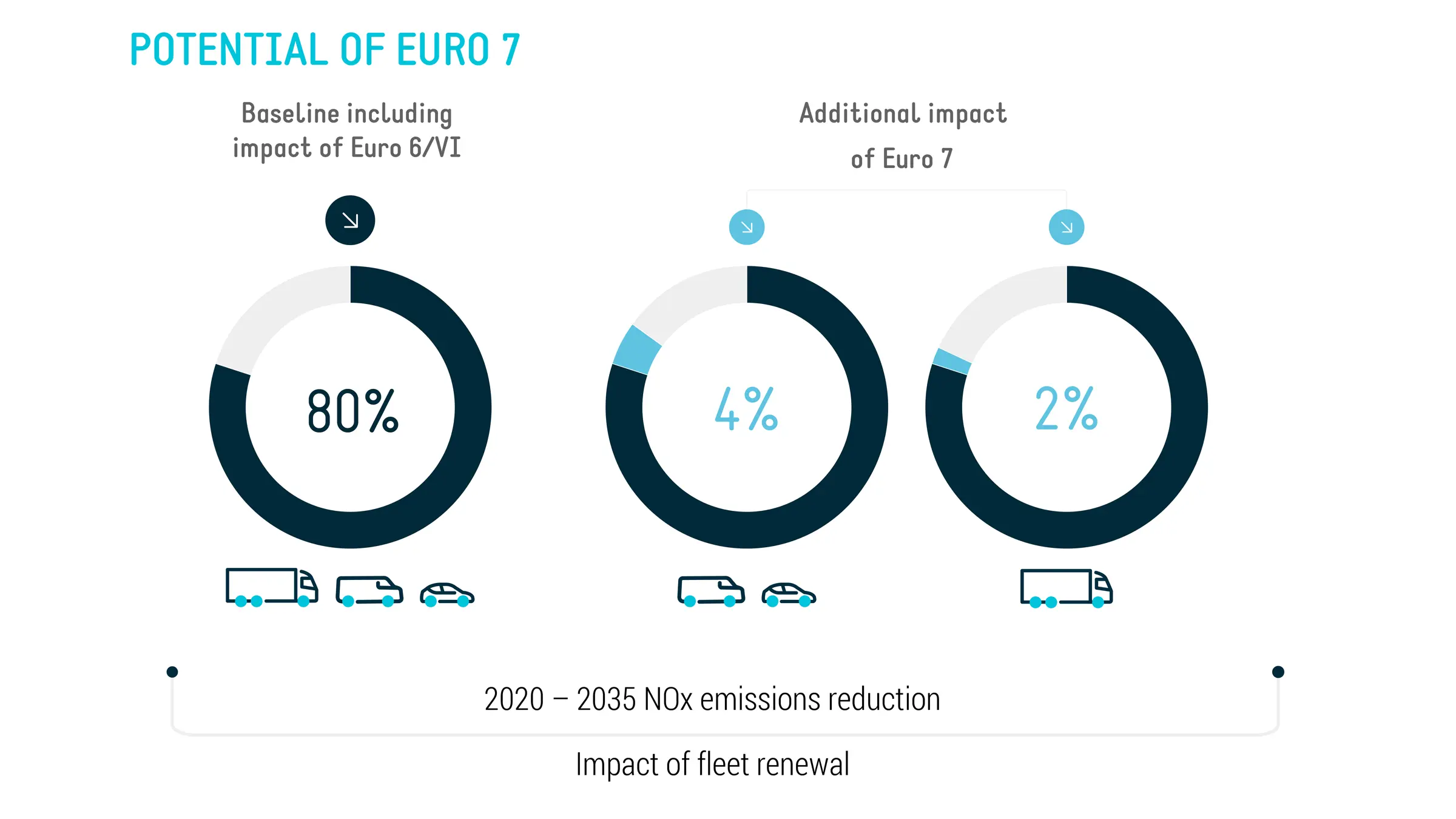

Understand Euro 6 emission standards and their impact on car manufacturing and air quality. Stay informed on environmental policy!

Mia Wilson

Find out the best websites for unbeatable budget travel deals. From flights to hotels, save big on your next trip!

Mia Wilson

Unlock effective strategies to meet your greenhouse gas reduction targets. Discover actionable tips and insights to make a real impact. Read now!

Mia Wilson

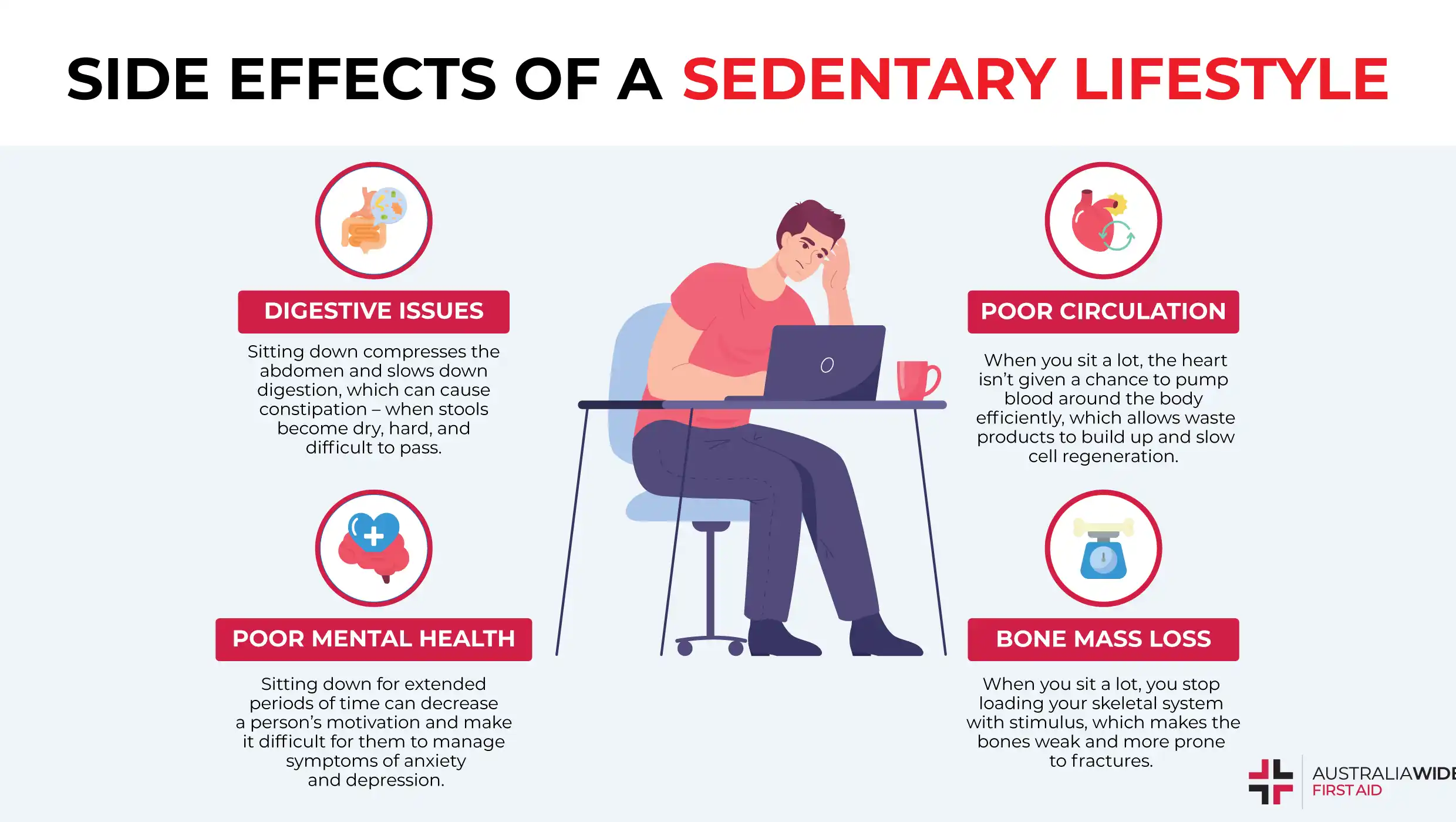

Uncover the dangers of prolonged inactivity on your health. Learn how to stay active and prevent health risks. Read more now!

Mia Wilson

Health

Education

View All

May 27, 2025

What Is Brown vs. Board of Education?

Explore the historic Brown vs. Board of Education case, its impact on civil rights, and its legacy. Learn why it matters today!

May 10, 2025

What Is Character Education?

Discover the importance of character education in schools and how it fosters ethical and emotional development. Learn more now!

April 25, 2025

Why Is Physical Education Important?

Learn why physical education is essential for health, academics, and personal growth. Get inspired to stay active!