What Are Emerging Markets? Explained

Mia Wilson

Photo: What Are Emerging Markets? Explained

What Are Emerging Markets? Explained

Global economies can be classified into different categories based on their level of development. Among these categories, emerging markets are perhaps the most dynamic and exciting. Understanding what emerging markets are, how they operate, and why they matter can provide valuable insights for investors, businesses, and policymakers.

Introduction: Defining Emerging Markets

Emerging markets are economies that are in the process of transitioning from low-income, less-developed status to a more robust and advanced state. These countries typically exhibit rapid industrialization, urbanization, and economic growth. While not yet reaching the stability and prosperity of developed markets, emerging markets present significant opportunities for investment due to their potential for expansion.

The term "emerging markets" was first popularized by economist Antoine Van Agtmael in the early 1980s. Since then, these economies have become key drivers of global economic progress. Common examples of emerging markets include Brazil, Russia, India, China, and South Africa collectively known as BRICS though there are many other countries that fit the criteria.

Characteristics of Emerging Markets

Emerging markets share several common characteristics that distinguish them from both developed and underdeveloped economies:

1. Rapid Economic Growth

Emerging markets often experience higher GDP growth rates compared to developed countries. This growth is fueled by increased industrialization, improved infrastructure, and a burgeoning middle class with greater purchasing power.

2. Market Volatility

While the potential for high returns is a major attraction, emerging markets can also be volatile. Factors such as political instability, regulatory uncertainty, and fluctuating currency values can lead to unpredictable market movements.

3. Improving Infrastructure

Investment in infrastructure is a hallmark of emerging markets. Governments and private sectors often focus on building roads, airports, power plants, and digital networks to support continued growth.

4. Expanding Middle Class

As these economies grow, so does their middle class. This segment of the population drives demand for goods and services, creating opportunities for both local and international businesses.

5. Foreign Direct Investment (FDI) Attraction

Emerging markets often attract significant FDI due to their growth potential. Multinational corporations (MNCs) invest in these regions to capitalize on cheaper labor costs, abundant natural resources, and expanding consumer bases.

Importance of Emerging Markets in the Global Economy

Emerging markets play a crucial role in the global economy by providing new avenues for growth and innovation. Here are a few reasons why they matter:

Diversification for Investors

For investors seeking to diversify their portfolios, emerging markets offer access to high-growth regions. While they come with risks, they also present opportunities for higher returns compared to established markets.

Global Supply Chain Integration

Emerging markets are often integral to global supply chains, supplying raw materials, manufacturing goods, and assembling products for international markets. Countries like China and Vietnam, for example, are key players in global manufacturing.

Innovation Hubs

As emerging markets grow, they become centers for innovation, particularly in technology and financial services. India’s thriving tech sector and Kenya’s fintech industry are notable examples.

Contribution to Global GDP

Emerging markets now account for a significant share of global GDP. According to the International Monetary Fund (IMF), emerging and developing economies collectively contribute more than 50% to global economic output.

Risks Associated with Investing in Emerging Markets

Despite their potential, emerging markets are not without risks. Investors and businesses must carefully assess these risks before committing resources. Common risks include:

1. Political and Regulatory Risks

Many emerging markets face political instability, corruption, and sudden regulatory changes. These factors can deter foreign investors and complicate business operations.

2. Currency Fluctuations

Currency risk is a significant concern when dealing with emerging markets. Exchange rate volatility can erode investment returns or increase the cost of doing business.

3. Limited Transparency

Corporate governance and financial reporting standards in emerging markets may not be as robust as in developed countries. This lack of transparency can pose risks for investors.

4. Economic Dependency

Some emerging markets rely heavily on specific industries or exports, such as oil, agriculture, or minerals. A downturn in global demand for these commodities can severely impact their economies.

Examples of Leading Emerging Markets

While there are numerous emerging markets worldwide, some have gained prominence due to their size and influence. Below are a few key examples:

1. China

China is often cited as a leading emerging market due to its rapid economic growth over the past few decades. With its transition from a primarily agrarian economy to a global industrial powerhouse, China has become the second-largest economy in the world.

2. India

India’s economy is driven by a combination of a large labor force, a booming tech industry, and growing consumer demand. Its democratic political system and ongoing economic reforms make it a prime destination for foreign investment.

3. Brazil

Brazil is known for its vast natural resources, including oil, minerals, and agricultural products. Its large domestic market and strategic location in South America have made it an attractive investment destination.

4. South Africa

South Africa stands out in the African continent as a diversified economy with a well-developed financial sector. Despite facing challenges like political instability, it remains a key emerging market due to its resource wealth and economic potential.

How to Invest in Emerging Markets

Investing in emerging markets can be done through several avenues:

1. Exchange-Traded Funds (ETFs)

ETFs that focus on emerging markets provide a convenient way for investors to gain exposure to a diversified portfolio of stocks from these regions.

2. Mutual Funds

Mutual funds specializing in emerging markets allow investors to benefit from professional management while diversifying their investments across multiple countries.

3. Direct Investments

For more experienced investors, direct investments in specific companies or industries within emerging markets can yield high returns. However, this approach requires careful due diligence.

4. Real Estate

Real estate investment in emerging markets can be lucrative, especially in rapidly urbanizing areas. Many investors seek opportunities in residential, commercial, and industrial real estate.

Conclusion: The Future of Emerging Markets

Emerging markets represent the future of global economic growth. As these countries continue to develop, they will play an increasingly vital role in shaping the world economy. While risks remain, the potential rewards for investors and businesses are substantial.

Understanding emerging markets is essential for anyone looking to capitalize on the opportunities they present. By staying informed about economic trends, political developments, and investment strategies, individuals and organizations can position themselves for success in these fast-evolving regions.

As globalization continues, the importance of emerging markets will only grow, making them a critical area of focus for investors, policymakers, and businesses alike.

For You

View AllUnderstand vocational education and how it prepares individuals for hands-on careers. Explore practical learning today!

Mia Wilson

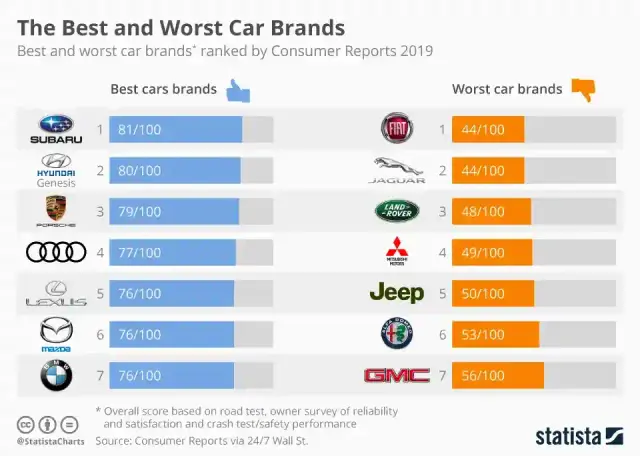

Discover the top performance car brands that dominate the market with speed, style, and innovation. Find your dream car now!

Mia Wilson

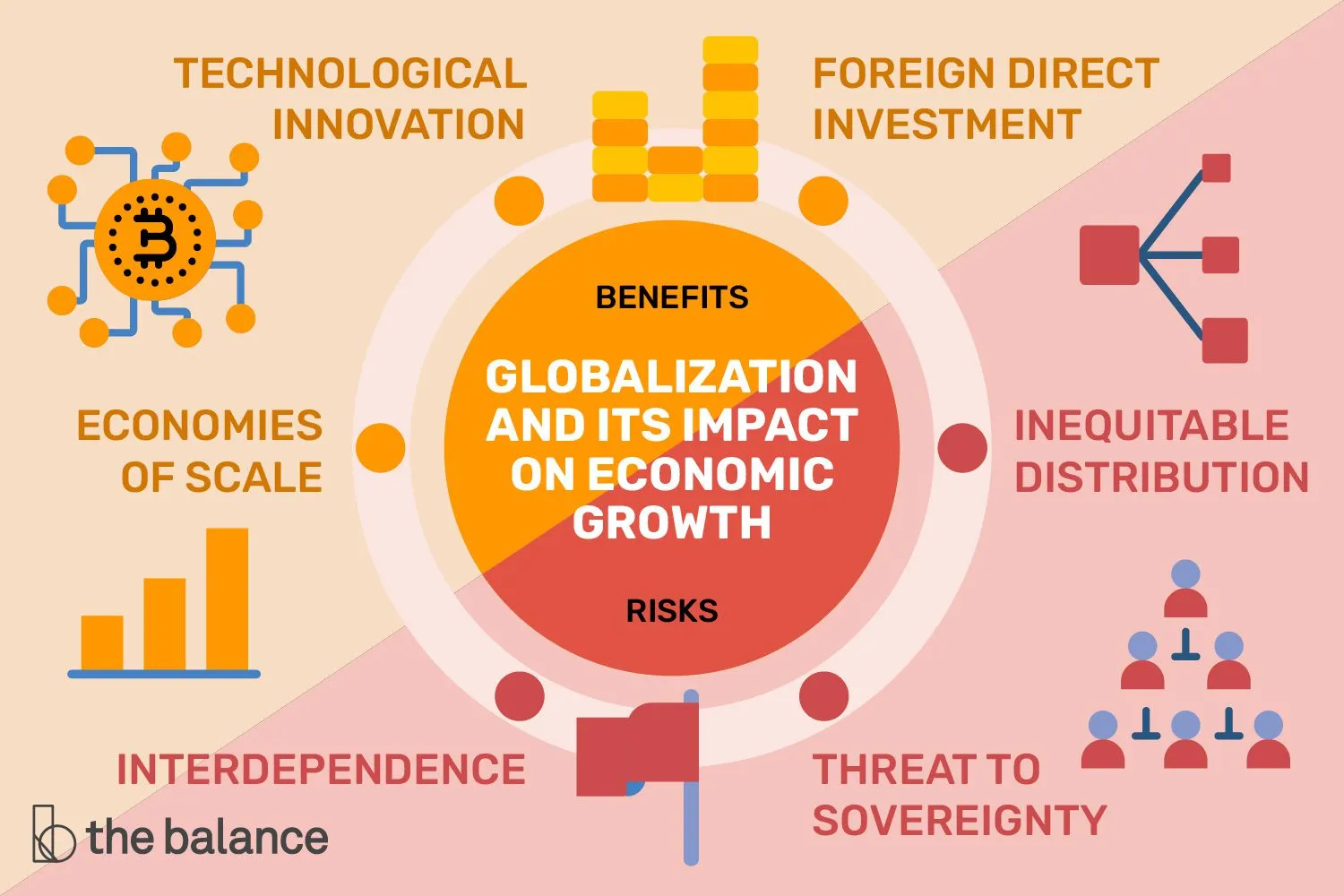

Learn how globalization impacts economies worldwide, from trade to employment. Click for a balanced analysis!

Mia Wilson

Discover educational psychology and how it enhances teaching and learning processes. Unlock better understanding today!

Mia Wilson

Compare run-flat tires with normal tires to see their pros, cons, and which is better for your driving needs. Learn more today!

Mia Wilson

Explore the latest blockchain trends and innovations shaping the digital future.

Mia Wilson

Education

View All

April 18, 2025

What Is Special Education?

Dive into special education, its purpose, and how it supports students with unique needs. Learn how it changes lives!

April 14, 2025

What Is Physical Education? Explained!

Discover the importance of physical education, its benefits, and why it's crucial for overall development. Learn more now!

April 25, 2025

Why Is Physical Education Important?

Learn why physical education is essential for health, academics, and personal growth. Get inspired to stay active!