Fiscal Policy Definition Made Clear

Mia Wilson

Photo: Fiscal Policy Definition Made Clear

Fiscal Policy Definition Made Clear

Introduction: Understanding the Role of Fiscal Policy

In the modern economic landscape, fiscal policy plays a pivotal role in shaping the direction of national economies. Governments worldwide rely on fiscal tools to manage economic performance, control inflation, and foster growth. But what exactly is fiscal policy? In simple terms, fiscal policy refers to how a government adjusts its spending and taxation levels to influence a country’s economy. This article breaks down the definition, importance, and real-world applications of fiscal policy in a clear and comprehensible manner.

What is Fiscal Policy? A Simplified Definition

Fiscal policy is the means by which a government controls its economic agenda through two primary levers government spending and taxation. By adjusting these levers, policymakers can either stimulate economic growth during a recession or cool down an overheated economy experiencing high inflation.

There are two main types of fiscal policy:

- Expansionary Fiscal Policy:

This approach is employed when the economy is sluggish, and there is a need to boost aggregate demand. It typically involves increased government spending and tax cuts to encourage consumer spending and business investment. - Contractionary Fiscal Policy:

On the other hand, contractionary policy is applied when inflation rates are high, and the economy needs to be slowed down. This method involves reducing government spending and raising taxes to decrease demand and curb inflation.

The Importance of Fiscal Policy in Economic Management

1. Stimulating Economic Growth

When a country faces an economic downturn, fiscal policy becomes a crucial tool for recovery. By increasing public expenditure on infrastructure, healthcare, and education, governments can create jobs and stimulate economic activity. Tax cuts, in parallel, leave individuals and businesses with more disposable income, boosting consumption and investment.

2. Controlling Inflation

High inflation erodes purchasing power, making goods and services more expensive for consumers. Through contractionary measures, such as tax hikes or reduced spending, fiscal policy can help stabilize prices and preserve economic stability.

3. Reducing Unemployment

Expansionary fiscal measures are often aimed at reducing unemployment by creating new job opportunities through increased government projects and incentives for businesses to hire more workers.

4. Ensuring Equitable Income Distribution

Governments can use progressive taxation and targeted social welfare programs to reduce income inequality. For example, higher taxes on the wealthy combined with subsidies or financial aid for lower-income households help create a more balanced economy.

Fiscal Policy vs. Monetary Policy: Key Differences

While fiscal policy involves government spending and taxation, monetary policy refers to the actions taken by a country’s central bank to manage money supply and interest rates. Both policies aim to achieve economic stability, but they operate differently:

| Aspect | Fiscal Policy | Monetary Policy |

|---|---|---|

| Implemented by | Government (Executive and Legislative) | Central Bank |

| Tools Used | Taxation, Government Spending | Interest Rates, Open Market Operations |

| Primary Goal | Influence Demand, Economic Growth | Control Inflation, Stabilize Currency |

| Time Lag | Longer time lag due to legislative process | Shorter time lag |

By coordinating fiscal and monetary policies effectively, governments and central banks can maintain balanced economic growth and avoid major recessions.

Real-World Examples of Fiscal Policy in Action

1. The Great Recession of 2008

During the financial crisis of 2008, many countries adopted expansionary fiscal policies to counter the economic downturn. The United States, for instance, passed the American Recovery and Reinvestment Act (ARRA), which allocated $831 billion to stimulate economic growth through tax cuts, unemployment benefits, and infrastructure projects.

2. COVID-19 Pandemic Response

In response to the economic fallout from the COVID-19 pandemic, governments around the world implemented significant fiscal measures. Stimulus packages, direct cash transfers, and increased healthcare spending were key components of these policies, aimed at preventing a global economic collapse.

Criticisms and Challenges of Fiscal Policy

While fiscal policy is a powerful economic tool, it is not without its challenges. Critics argue that poorly executed fiscal strategies can lead to unintended consequences, such as:

1. Increased National Debt

Frequent reliance on expansionary fiscal policy can lead to high levels of national debt. If a government continuously borrows to finance its spending, it risks a debt crisis that can undermine long-term economic stability.

2. Crowding Out Effect

Excessive government borrowing can drive up interest rates, making it more expensive for businesses and individuals to borrow. This phenomenon, known as the “crowding out effect,” can stifle private investment and hinder economic growth.

3. Political Influence

Fiscal policy decisions are often subject to political considerations, which can result in short-term measures aimed at winning public approval rather than addressing long-term economic issues.

Best Practices for Effective Fiscal Policy

To maximize the effectiveness of fiscal policy while minimizing its downsides, governments should adhere to several best practices:

- Maintaining Fiscal Discipline: Governments should balance expansionary policies with measures to reduce deficits during periods of economic growth.

- Targeted Spending: Public expenditure should be directed towards areas with the highest potential for economic returns, such as infrastructure, education, and healthcare.

- Transparency and Accountability: Clear communication of fiscal measures and their intended outcomes helps build public trust and ensures that policymakers are held accountable.

Conclusion: Fiscal Policy as a Pillar of Economic Stability

Fiscal policy is an essential tool for managing the complexities of a modern economy. By carefully balancing government spending and taxation, policymakers can influence economic growth, control inflation, and reduce unemployment. However, it requires thoughtful execution and coordination with other economic policies to avoid pitfalls such as high debt or inflationary pressures.

Understanding fiscal policy and its implications enables citizens to engage more meaningfully in discussions about economic policy. Whether during times of crisis or stability, fiscal policy remains a key instrument for ensuring sustainable development and prosperity.

For You

View AllDiscover the ultimate luxury car brands that define sophistication, innovation, and performance. See the top picks now!

Mia Wilson

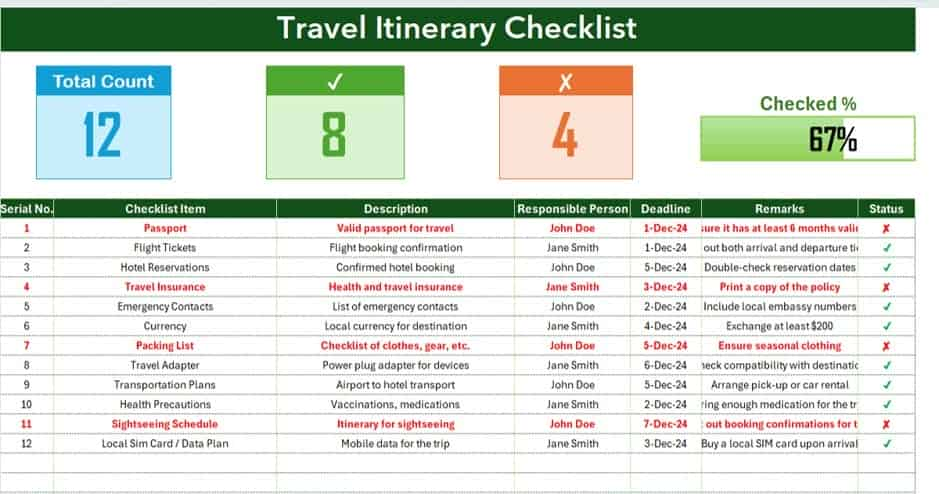

Never miss a detail with this travel itinerary checklist. Ensure your trips are smooth, organized, and unforgettable with these essential tips!

Mia Wilson

Get a beginner’s guide to cryptocurrency, its workings, and why it’s transforming finance. Click to stay informed!

Mia Wilson

Understand Foreign Direct Investment (FDI), its benefits, and its role in global trade. Click for a comprehensive guide!

Mia Wilson

Learn about secondary education, its structure, and its role in shaping academic and career paths. Get insights today!

Mia Wilson

Uncover the meaning of venture capital, its benefits, and how it fuels startups. Click to understand its role in business!

Mia Wilson

Education

View All

April 22, 2025

What Is Early Childhood Education?

Explore early childhood education, its benefits, and how it shapes a child’s future. Start building strong foundations!

April 19, 2025

What Is Higher Education?

Understand higher education, its benefits, and how it shapes future opportunities. Explore your potential now!

April 18, 2025

What Is Special Education?

Dive into special education, its purpose, and how it supports students with unique needs. Learn how it changes lives!