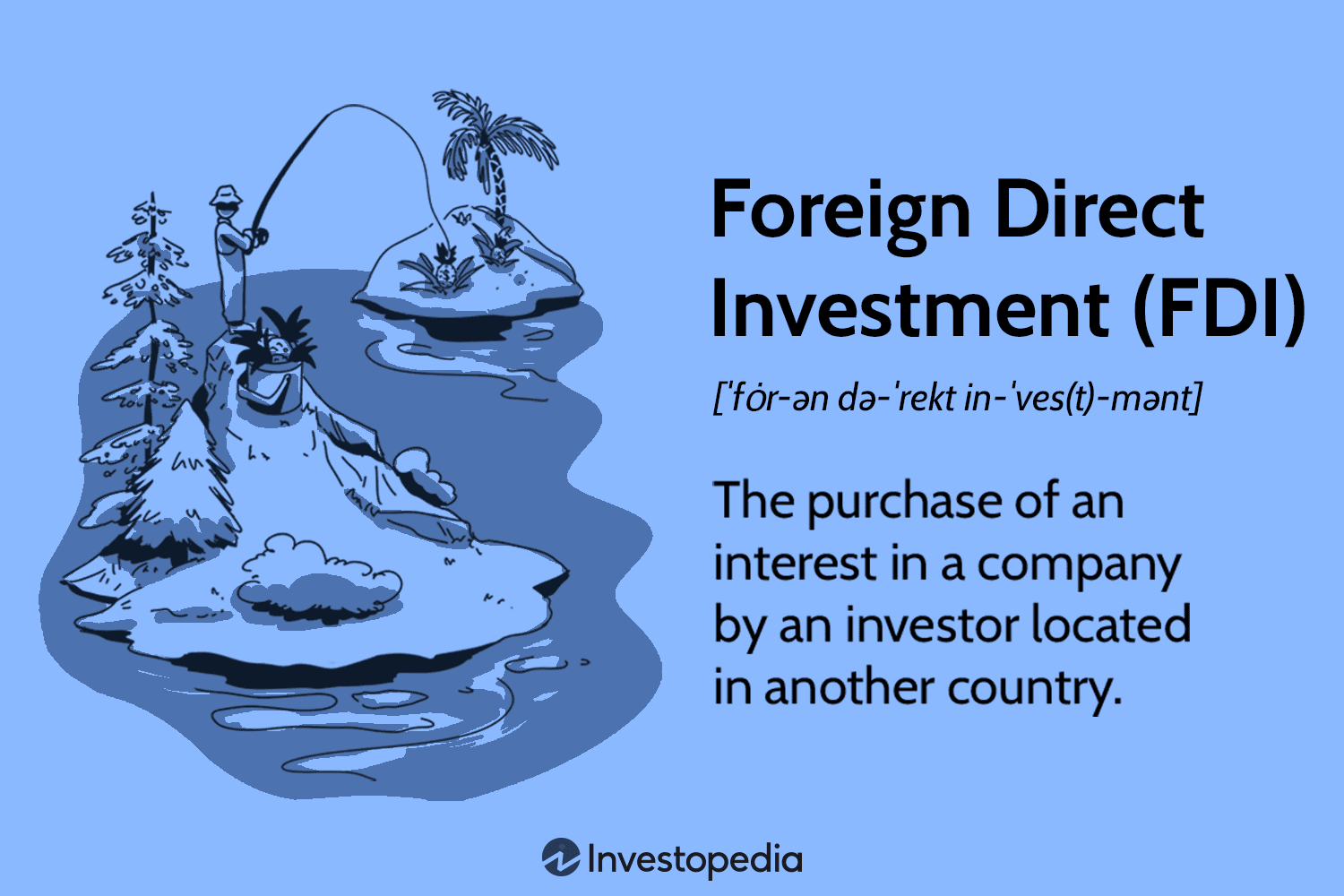

What Is FDI? Foreign Direct Investment 101

Mia Wilson

Photo: What Is FDI? Foreign Direct Investment 101

What Is FDI? Foreign Direct Investment 101

Foreign Direct Investment (FDI) plays a crucial role in the global economy, fostering international collaboration, boosting economic growth, and facilitating the exchange of technology and expertise. Whether you are a business owner seeking expansion opportunities or an individual interested in understanding economic trends, grasping the concept of FDI is essential. This article provides a comprehensive guide on what FDI is, its types, benefits, and potential risks.

Understanding Foreign Direct Investment

At its core, Foreign Direct Investment refers to an investment made by a company or individual in one country into business interests located in another country. Unlike portfolio investments, which involve purchasing stocks or bonds in a foreign company, FDI entails acquiring a lasting interest and often significant management control in a foreign enterprise.

Key Characteristics of FDI

- Ownership Control: FDI usually involves a minimum ownership stake of 10% in a foreign company, granting the investor significant influence over management.

- Long-Term Commitment: Unlike speculative investments, FDI is intended to be a long-term venture.

- Direct Involvement: Investors are often involved in decision-making and day-to-day operations.

Forms of FDI

FDI can take several forms depending on the mode of entry and the nature of the investment:

- Greenfield Investment Greenfield investments occur when a company establishes a new operation from scratch in a foreign country. This involves constructing new facilities, hiring staff, and developing supply chains. This form of FDI is common in sectors like manufacturing and technology.

- Brownfield Investment In contrast, brownfield investments involve acquiring or leasing existing facilities in a foreign country. This strategy allows companies to bypass the time and expense associated with constructing new operations.

- Joint Ventures A joint venture involves collaboration between a foreign investor and a local partner to establish a new enterprise. This approach is often chosen when navigating regulatory environments or market complexities in the host country.

- Mergers and Acquisitions (M&A) Mergers and acquisitions involve purchasing an existing foreign company or merging with it. This form of FDI provides immediate market access and operational capacity.

Benefits of Foreign Direct Investment

FDI brings numerous advantages to both host countries and investing firms, contributing to economic development and business growth.

For Host Countries

- Economic Growth: FDI can stimulate economic activity by creating jobs, increasing productivity, and boosting local industries.

- Access to Technology and Expertise: Host countries benefit from the transfer of advanced technology, managerial expertise, and industry best practices, helping local businesses improve their competitiveness.

- Infrastructure Development: In many cases, foreign investors contribute to the development of infrastructure such as roads, ports, and utilities, which can have lasting positive impacts on the local economy.

- Improved Balance of Payments: FDI inflows can help improve a country’s balance of payments by providing a stable source of foreign capital.

For Investing Companies

- Market Diversification: Investing in foreign markets allows companies to diversify their revenue streams and reduce dependency on their domestic market.

- Access to Resources: FDI provides access to key resources, including raw materials, talent, and new consumer markets.

- Competitive Advantage: Establishing a local presence in foreign markets helps companies gain a competitive edge by better understanding and serving local customers.

- Higher Returns: By expanding into emerging markets with high growth potential, companies can achieve higher returns on investment.

Risks and Challenges of FDI

Despite its many advantages, FDI comes with several risks and challenges that investors must carefully consider.

Political Risks

Changes in government policies, political instability, or regulatory shifts in the host country can affect the profitability of FDI.

Cultural Barriers

Differences in language, business practices, and culture can pose challenges for foreign investors, requiring them to adapt their strategies.

Economic Risks

Economic downturns, inflation, or currency fluctuations in the host country can reduce the expected returns on FDI.

Regulatory Risks

Many countries impose restrictions on foreign ownership or require local partnerships, which can complicate the investment process.

Global Trends in FDI

In recent years, global FDI patterns have shifted due to changing economic conditions, trade tensions, and advancements in technology. Key trends include:

- Increased FDI in Emerging Markets Emerging economies, particularly in Asia and Africa, have seen significant FDI inflows due to their growth potential and favorable demographics.

- Focus on Technology and Innovation Many FDI projects are now concentrated in high-tech industries, including information technology, renewable energy, and biotechnology.

- Sustainability and ESG Considerations Environmental, Social, and Governance (ESG) factors are increasingly influencing FDI decisions, with investors prioritizing sustainable and socially responsible projects.

- Reshoring and Nearshoring Due to disruptions in global supply chains and geopolitical tensions, some companies are opting to relocate operations closer to home markets, a trend known as reshoring or nearshoring.

Case Studies of Successful FDI Projects

- Apple in China Apple’s extensive investment in manufacturing facilities in China has allowed it to scale production rapidly while gaining access to skilled labor and efficient supply chains.

- Toyota in the United States Toyota’s investments in manufacturing plants across the U.S. have created thousands of jobs and contributed significantly to the local economy, while enhancing the company’s brand presence.

- Tesla in Germany Tesla’s Gigafactory in Germany is a prime example of FDI aimed at tapping into advanced engineering talent and serving the European market efficiently.

Conclusion

Foreign Direct Investment is a powerful driver of global economic integration, fostering growth, innovation, and cross-border collaboration. For host countries, FDI offers an avenue for development, job creation, and technology transfer. For investing firms, it presents opportunities to expand, diversify, and gain a foothold in new markets. However, like any investment, FDI carries inherent risks, including political, economic, and regulatory challenges.

Understanding the intricacies of FDI helps businesses and policymakers make informed decisions, ensuring that the benefits outweigh the risks. As the global economy continues to evolve, FDI will remain a critical component of international business strategy, shaping the future of industries and economies alike.

For You

View AllUnderstand what public-private partnerships are and how they drive infrastructure development. Click to learn more!

Mia Wilson

Stay ahead with this essential car maintenance checklist. Keep your vehicle running smoothly and avoid costly repairs. Learn now!

Mia Wilson

Step-by-step guide to setting up your own VPS quickly and easily.

Mia Wilson

Discover free activities and attractions for budget travelers. Explore more without spending a fortune!

Mia Wilson

Understand the bond market, its role in financing, and how it impacts the economy. Click to learn more!

Mia Wilson

Learn what emerging markets are, their characteristics, and their role in the global economy. Click to explore new opportunities!

Mia Wilson

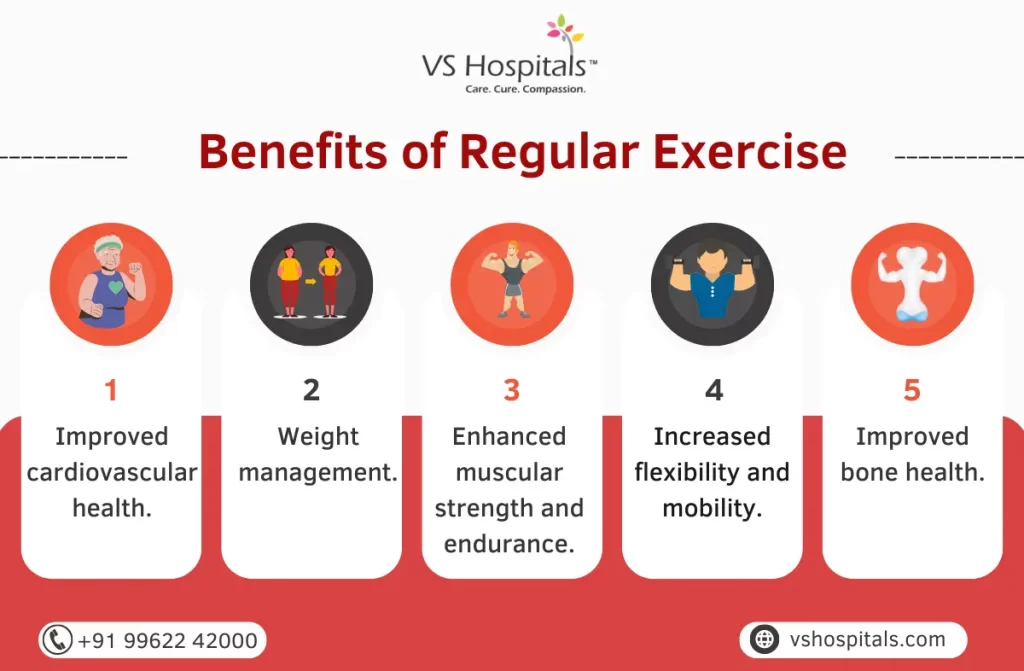

Health

Education

View All

May 14, 2025

What Is Classical Education? Explained!

Discover the principles of classical education, its history, and how it fosters critical thinking. Learn the benefits today!

April 24, 2025

What Is Distance Education? Explained!

Discover how distance education works, its benefits, and how it’s transforming learning. Start your journey today!

May 29, 2025

How Technology Has Changed Education

Discover how technology is revolutionizing education, enhancing accessibility, and transforming classrooms. Learn more now!