How Do Exchange Rates Work?

Mia Wilson

Photo: How Do Exchange Rates Work?

How Do Exchange Rates Work?

Exchange rates play a crucial role in international finance, trade, and investment. Whether you are a frequent traveler, a business owner dealing with foreign clients, or an investor looking to diversify your portfolio, understanding how exchange rates work can help you make informed decisions. This article will break down the factors influencing exchange rates, explain the different types of exchange rate systems, and provide insights into why exchange rates fluctuate.

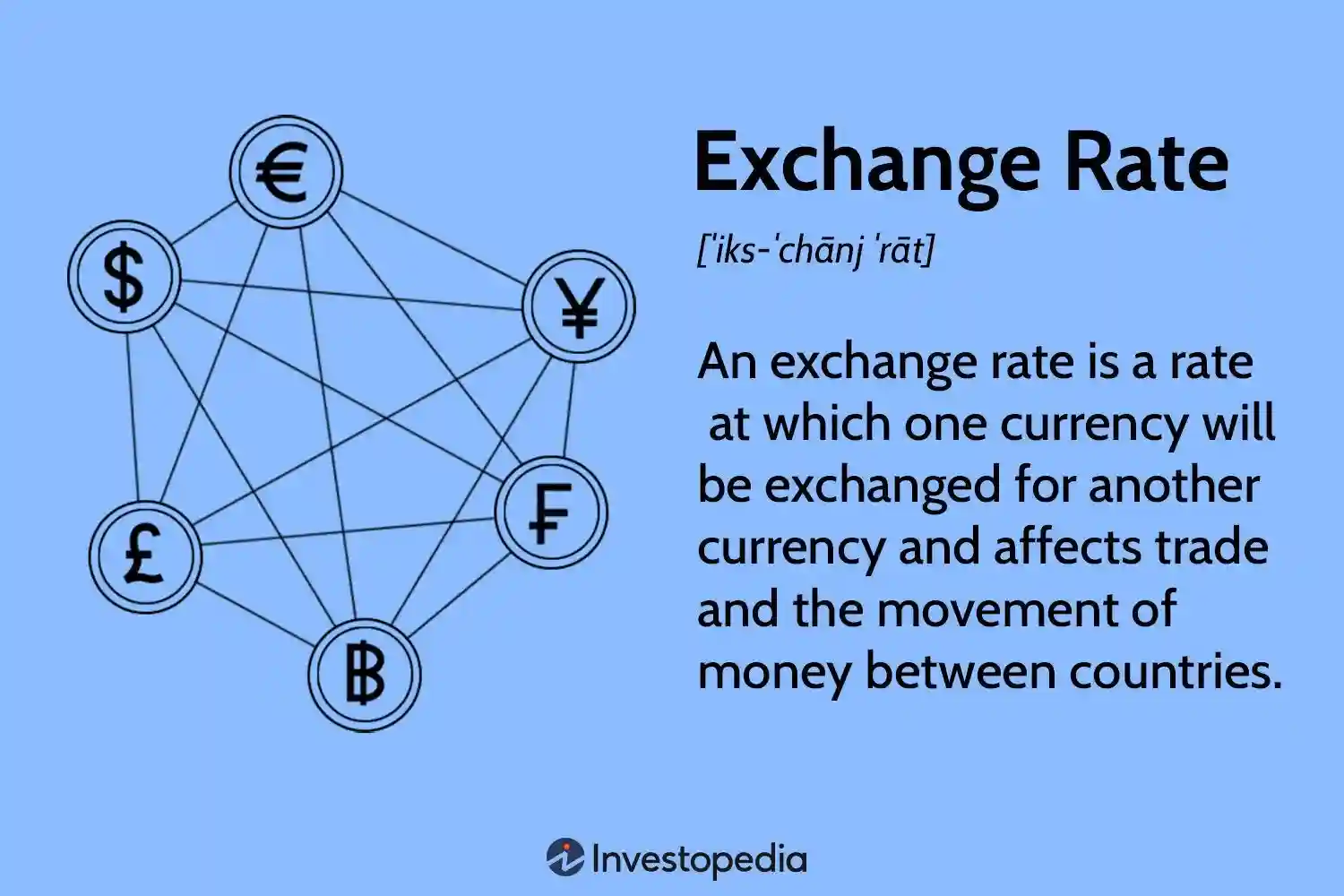

What Are Exchange Rates?

An exchange rate is the value of one currency in relation to another. It determines how much of one currency you need to exchange for another. For example, if the exchange rate between the US dollar (USD) and the euro (EUR) is 1.2, it means 1 USD can be exchanged for 1.2 EUR.

Types of Exchange Rate Systems

There are primarily two types of exchange rate systems used by countries around the world:

1. Fixed Exchange Rate System

In a fixed exchange rate system, a country’s currency is pegged to another major currency, such as the USD or gold. Central banks maintain the fixed rate by buying or selling their own currency in the foreign exchange market.

- Example: Countries like Saudi Arabia peg their currency to the US dollar to maintain stability in trade.

- Advantage: Reduces uncertainty in international transactions and encourages foreign investment.

- Disadvantage: Limits a country’s ability to respond to economic changes and forces central banks to hold large reserves of foreign currency.

2. Floating Exchange Rate System

In a floating exchange rate system, the value of a currency is determined by market forces supply and demand in the foreign exchange market.

- Example: Major currencies like the USD, EUR, and JPY operate under a floating exchange rate system.

- Advantage: Allows for automatic adjustment of the currency value based on economic conditions.

- Disadvantage: Can result in high volatility, which may deter trade and investment.

Factors Influencing Exchange Rates

Several factors drive exchange rate fluctuations. Understanding these factors can help predict changes in currency values and their potential impact.

1. Interest Rates

Interest rates set by a country’s central bank directly affect its currency value. Higher interest rates attract foreign investment, increasing demand for the currency and causing its value to rise.

- Example: If the US Federal Reserve increases interest rates, the demand for USD typically rises, leading to an appreciation in its value.

2. Inflation Rates

Currencies of countries with lower inflation rates tend to appreciate relative to those with higher inflation rates. Low inflation enhances a currency’s purchasing power, making it more attractive.

- Key Insight: Maintaining low inflation is critical for long-term currency stability.

3. Political Stability and Economic Performance

Investors prefer stable countries with strong economic performance, which boosts demand for the local currency. Political turmoil or economic instability can trigger capital flight, depreciating the currency.

4. Balance of Payments

A country’s balance of payments, which includes its trade balance (exports minus imports), can influence its currency value. A trade surplus typically strengthens a currency, while a trade deficit weakens it.

- Case Study: China’s long-standing trade surplus has contributed to the stability of the yuan over the years.

5. Speculation

Currency traders and speculators can influence short-term exchange rate movements by betting on future currency values. Large speculative activities can lead to sharp fluctuations in exchange rates.

How Are Exchange Rates Quoted?

Exchange rates are usually quoted in two ways:

- Direct Quote: The domestic currency is the base currency, and the foreign currency is the quote currency.

- Example: 1 USD = 0.85 EUR (for someone in the US).

- Indirect Quote: The foreign currency is the base currency, and the domestic currency is the quote currency.

- Example: 1 EUR = 1.18 USD (for someone in the Eurozone).

Why Do Exchange Rates Fluctuate?

Exchange rates fluctuate due to changes in supply and demand dynamics in the foreign exchange market. Here are some key reasons behind these changes:

- Market Sentiment: News events, geopolitical developments, and economic data releases can impact investor sentiment and cause fluctuations.

- Central Bank Interventions: Central banks may intervene in the foreign exchange market to stabilize their currency or achieve specific economic goals.

- Global Events: Events such as pandemics, wars, or natural disasters can lead to rapid changes in exchange rates as investors seek safe-haven currencies like the USD or CHF (Swiss franc).

Real-World Applications of Exchange Rates

1. International Trade

Businesses that import or export goods and services are directly affected by exchange rate changes. A weaker domestic currency makes imports more expensive but boosts exports by making them cheaper for foreign buyers.

2. Travel and Tourism

Tourists need to exchange their domestic currency for foreign currency when traveling abroad. A stronger domestic currency gives tourists more purchasing power, while a weaker one reduces it.

3. Investments

Exchange rates influence returns on foreign investments. Investors in global markets must consider currency risk, as fluctuations can either enhance or erode returns.

- Tip: Diversifying investments across different currencies can help mitigate currency risk.

Managing Exchange Rate Risk

Businesses and investors can manage exchange rate risk through various strategies, including:

- Hedging: Using financial instruments like forward contracts, options, and futures to lock in exchange rates and protect against adverse movements.

- Diversification: Spreading investments across multiple currencies to reduce reliance on any single currency.

- Monitoring Economic Indicators: Keeping a close eye on economic reports, central bank policies, and geopolitical events to anticipate potential currency movements.

Conclusion

Exchange rates are a fundamental aspect of the global economy, influencing trade, investment, and everyday financial transactions. They are determined by a complex interplay of factors, including interest rates, inflation, political stability, and market sentiment. Understanding how exchange rates work can empower businesses, investors, and individuals to make smarter financial decisions and manage risks effectively.

Whether you are a frequent traveler, an exporter, or an investor, staying informed about currency trends and employing strategies to mitigate exchange rate risk can help you navigate the ever-changing world of international finance. As global markets become increasingly interconnected, keeping an eye on exchange rate movements will continue to be essential for anyone engaged in cross-border activities.

For You

View AllFind out whether an SUV or a sedan is the better choice for your lifestyle. Compare space, performance, and efficiency now!

Mia Wilson

Discover the importance of health education in promoting wellness and preventing diseases. Start your journey to health today!

Mia Wilson

Get insights into VPS hosting prices and how to choose an affordable plan.

Mia Wilson

Save money while traveling with these 10 genius budget travel hacks. Explore the world without emptying your wallet!

Mia Wilson

Dive into special education, its purpose, and how it supports students with unique needs. Learn how it changes lives!

Mia Wilson

Learn why physical education is essential for health, academics, and personal growth. Get inspired to stay active!

Mia Wilson

Health

Education

View All

June 1, 2025

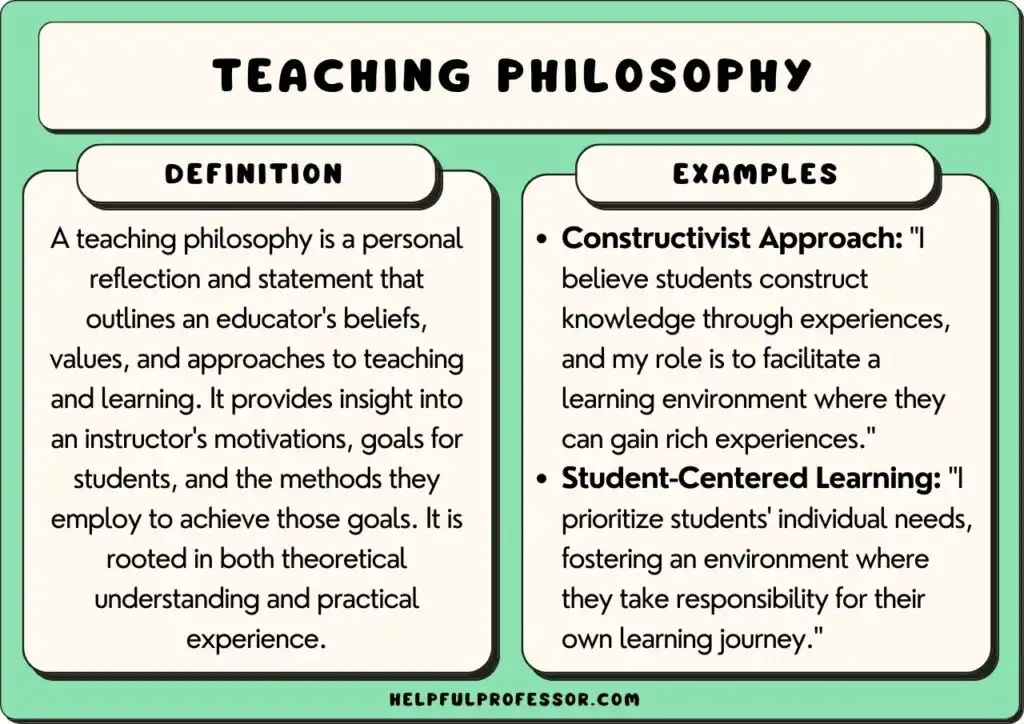

What Is Your Philosophy of Education?

Reflect on your philosophy of education, its core values, and how it influences teaching and learning practices. Discover your approach today!

April 14, 2025

What Is Physical Education? Explained!

Discover the importance of physical education, its benefits, and why it's crucial for overall development. Learn more now!

April 19, 2025

What Is Higher Education?

Understand higher education, its benefits, and how it shapes future opportunities. Explore your potential now!