Public Debt: Meaning and Impact

Mia Wilson

Photo: Public Debt: Meaning and Impact

Public Debt: Meaning and Impact

Introduction: Understanding Public Debt

Public debt, often referred to as government debt or national debt, represents the total amount of money that a government owes to creditors. This debt can be incurred domestically or internationally, and it typically results from government borrowing to fund public spending, infrastructure projects, and social welfare programs. While borrowing can help a country stimulate its economy and manage fiscal shortfalls, excessive public debt can have long-term economic consequences. Understanding the meaning, causes, and impact of public debt is essential for evaluating its role in economic stability and growth.

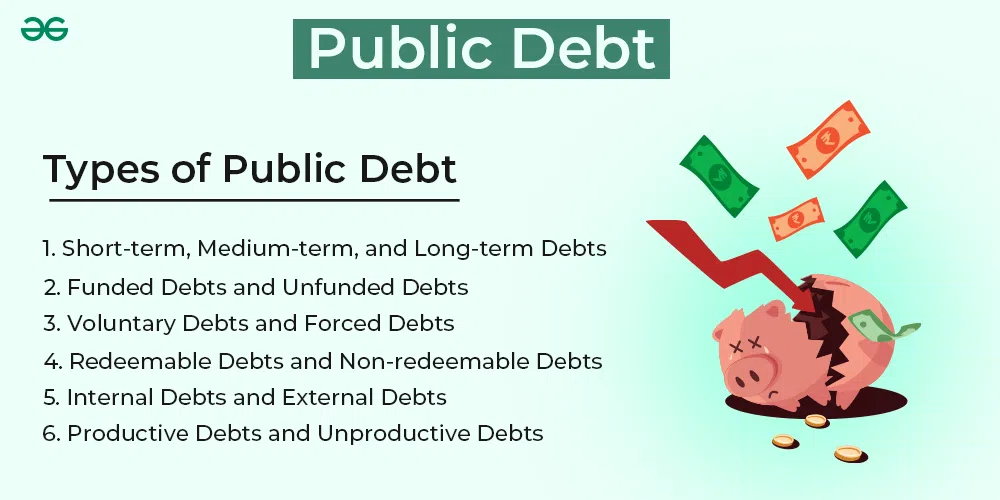

What is Public Debt?

At its core, public debt is a financial obligation created when a government borrows money to cover expenditures exceeding its revenue. Governments raise funds through two primary methods: issuing bonds and taking loans from international institutions such as the World Bank or the International Monetary Fund (IMF). Bonds can be sold to private investors, financial institutions, and even foreign governments, making public debt a widespread and often global financial concern.

There are generally two types of public debt:

- Internal Debt: Debt owed to creditors within the country.

- External Debt: Debt owed to foreign creditors, including international financial organizations and foreign governments.

Governments may resort to borrowing for various reasons, including economic crises, funding development projects, or covering short-term fiscal deficits. However, managing this debt responsibly is critical to prevent negative economic repercussions.

Causes of Public Debt

Several factors contribute to the accumulation of public debt, including:

- Economic Downturns

During recessions or economic crises, governments often increase spending to stimulate economic activity. Reduced tax revenues coupled with higher social welfare costs can lead to significant borrowing. - Infrastructure Development

Large-scale infrastructure projects require substantial upfront investments. Since such projects are vital for long-term economic growth, governments frequently fund them through debt. - War and Defense Spending

Military conflicts or heightened defense spending often lead to rapid debt accumulation. History offers numerous examples of countries accruing significant debt during wartime. - Social Welfare Programs

Expanding social welfare programs, such as healthcare and pensions, can strain public finances, especially in aging societies. To maintain these services, governments may increase borrowing. - Natural Disasters

Catastrophic events like earthquakes, floods, or pandemics often compel governments to borrow heavily to fund relief and rebuilding efforts.

Impact of Public Debt on the Economy

Public debt has both positive and negative impacts on a country's economy. While manageable debt levels can foster economic growth, excessive debt may lead to financial instability. Below is a detailed analysis of its potential effects:

Positive Impacts

- Economic Stimulus

When used judiciously, public debt can stimulate economic growth by financing critical infrastructure, creating jobs, and boosting demand. Keynesian economic theory supports this approach, arguing that government borrowing can help smooth out economic cycles. - Improved Public Services

Borrowing allows governments to invest in healthcare, education, and public transportation, leading to improved living standards and long-term economic benefits. - Attracting Foreign Investment

A well-managed public debt portfolio signals economic stability, which can attract foreign investors. This, in turn, boosts capital inflows and fosters economic development.

Negative Impacts

- Crowding Out Effect

High public debt can lead to increased interest rates, which may discourage private investment. When governments borrow heavily, they compete with the private sector for available capital, potentially stifling business growth. - Higher Tax Burden

To repay debt, governments may increase taxes, which can reduce disposable income and slow down economic activity. Over time, higher taxes can also dampen consumer and business confidence. - Risk of Default

Excessive external debt increases the risk of sovereign default, which occurs when a country cannot meet its debt obligations. This can lead to severe economic crises and loss of access to international financial markets. - Inflationary Pressures

In some cases, excessive borrowing can lead to inflation. When governments resort to printing money to finance debt, it can dilute the currency’s value, causing prices to rise.

Managing Public Debt: Strategies and Solutions

Effective public debt management is crucial for maintaining economic stability. Here are some strategies governments can adopt:

- Fiscal Discipline

Governments should aim to balance their budgets during periods of economic growth to reduce the need for borrowing. This involves controlling public spending and ensuring efficient allocation of resources. - Debt Restructuring

In cases where debt becomes unsustainable, countries may negotiate with creditors to restructure their debt. This can include extending repayment periods, reducing interest rates, or even partial debt forgiveness. - Diversifying the Economy

A diversified economy is less vulnerable to external shocks, reducing the likelihood of excessive borrowing. Governments can encourage sectors like technology, manufacturing, and tourism to boost revenue streams. - Strengthening Tax Collection

Improving tax collection mechanisms can increase government revenue without raising tax rates. Measures such as digital tax systems and reducing tax evasion can significantly enhance fiscal health.

Global Examples of Public Debt Management

Several countries offer lessons in effective public debt management:

- Japan

Japan has one of the highest public debt-to-GDP ratios in the world. However, it has managed to maintain economic stability due to high domestic ownership of its debt and low interest rates. - Greece

Greece’s debt crisis in the late 2000s serves as a cautionary tale. Unsustainable borrowing and fiscal mismanagement led to severe austerity measures and a prolonged economic downturn. - United States

The U.S. regularly incurs high levels of public debt but benefits from the dollar's status as a global reserve currency, which helps mitigate risks associated with borrowing.

Conclusion: Striking a Balance

Public debt is a double-edged sword it can be a powerful tool for economic development but also a source of financial instability if mismanaged. Striking a balance between necessary borrowing and fiscal responsibility is key to maintaining long-term economic health. By adopting sound debt management practices and promoting economic growth, governments can ensure that public debt remains a benefit rather than a burden.

For individuals interested in learning more about public finance and its implications, numerous online courses and financial institutions offer detailed resources on this topic. Understanding public debt not only enhances financial literacy but also empowers citizens to engage in informed discussions about national policies.

For You

View AllExplore the purpose and impact of antitrust laws in promoting fair competition. Click to learn more about market fairness!

Mia Wilson

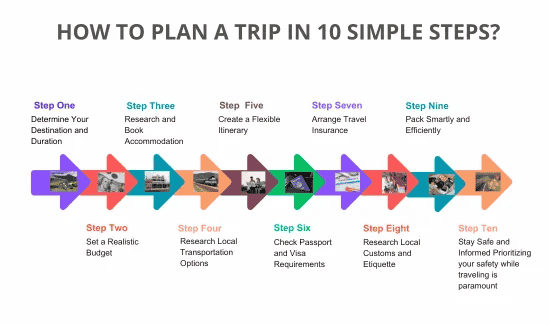

Discover 10 ideal travel itineraries designed for beginners. Simplify your trips with these easy-to-follow plans for stress-free travel!

Mia Wilson

Unveil 7 hidden adventure destinations perfect for thrill-seekers. Escape the ordinary and discover your next great adventure.

Mia Wilson

Discover the importance of health education in promoting wellness and preventing diseases. Start your journey to health today!

Mia Wilson

Learn the effects of dehydration on the body and how to prevent it. Protect your health today!

Mia Wilson

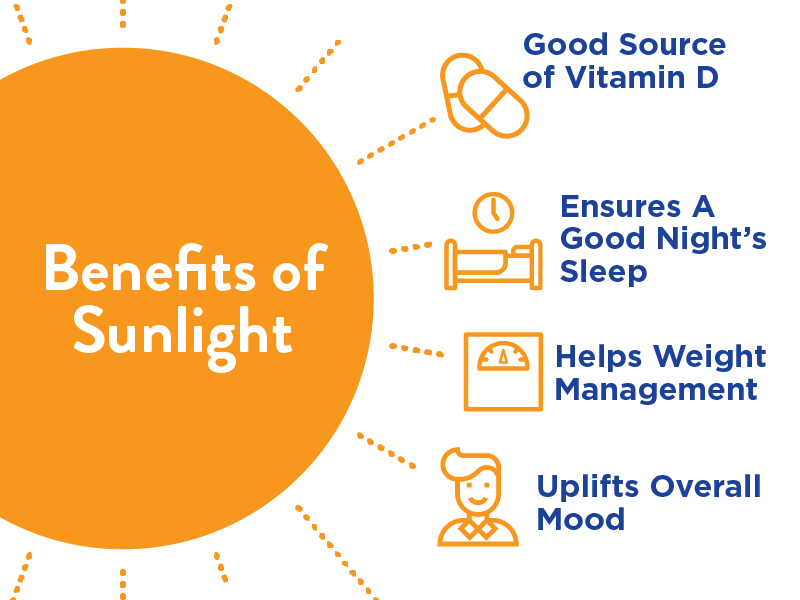

Explore the surprising benefits of sun exposure for your health and well-being. Embrace the sunshine today!

Mia Wilson

Health

Education

View All

May 9, 2025

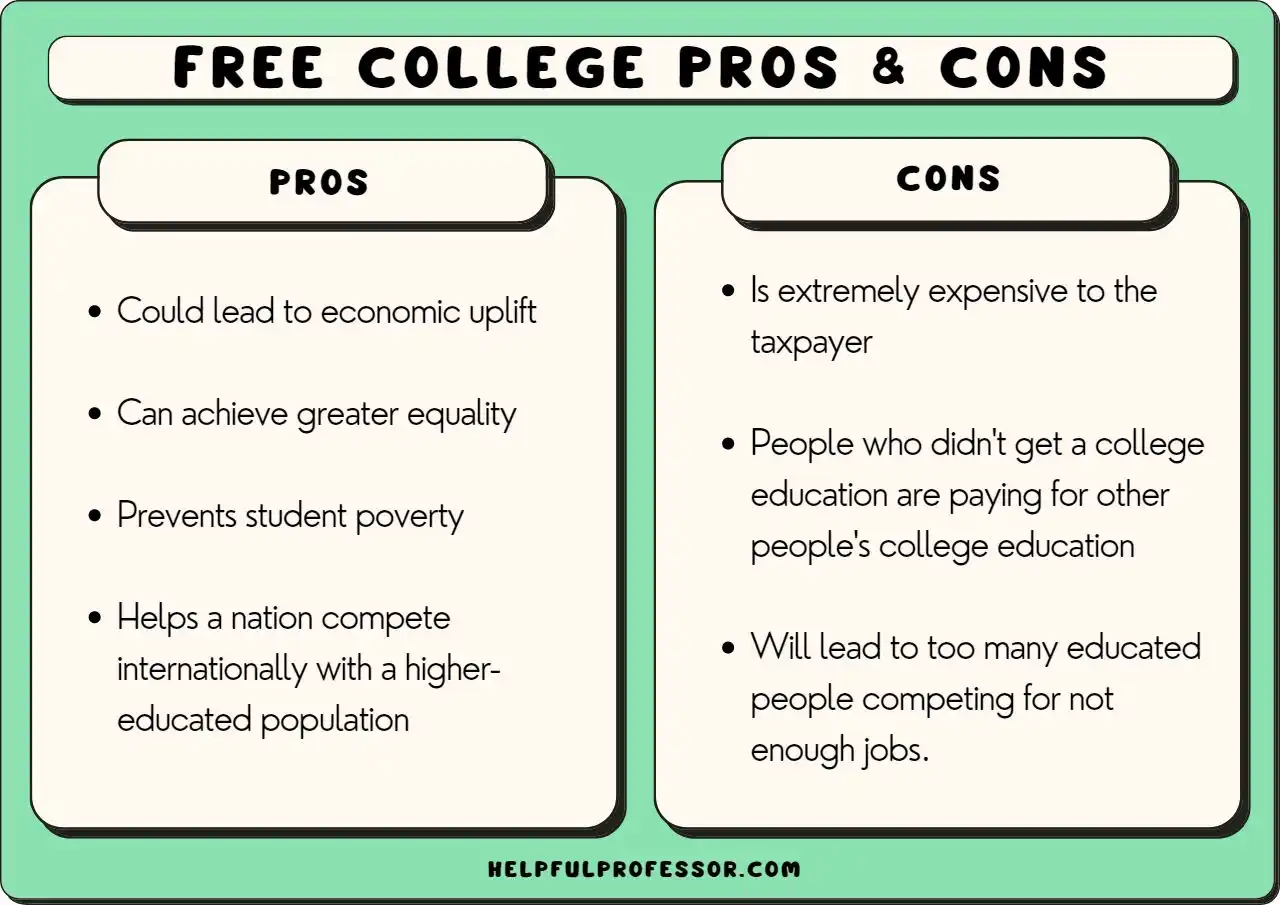

Should College Education Be Free?

Dive into the debate over free college education, its pros and cons, and its potential impact on society. Join the conversation!

May 13, 2025

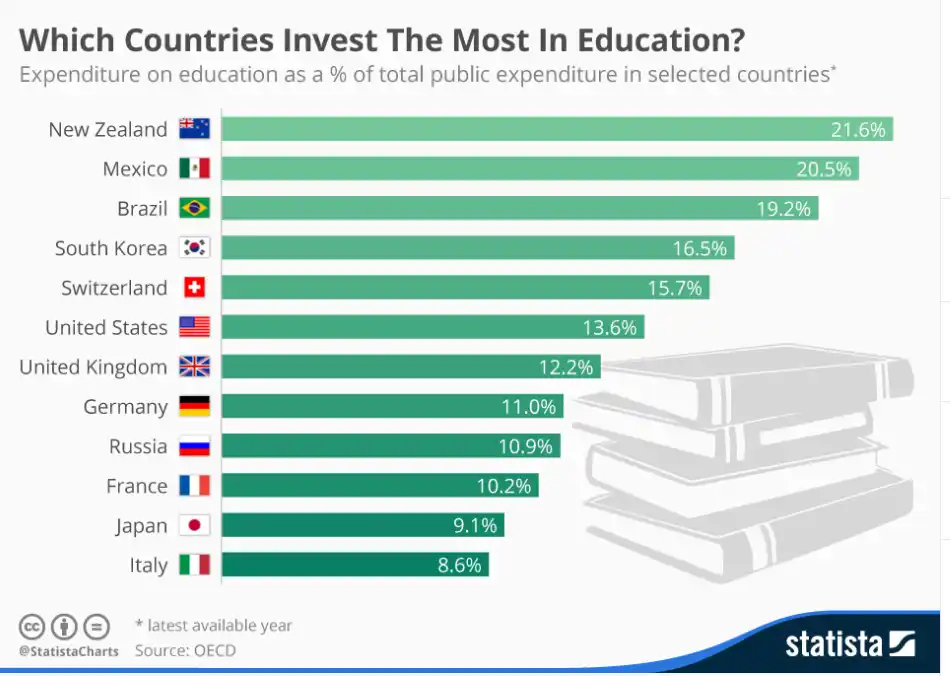

What Country Has the Best Education?

Find out which country tops global education rankings and what sets its education system apart. Discover the secrets today!

April 29, 2025

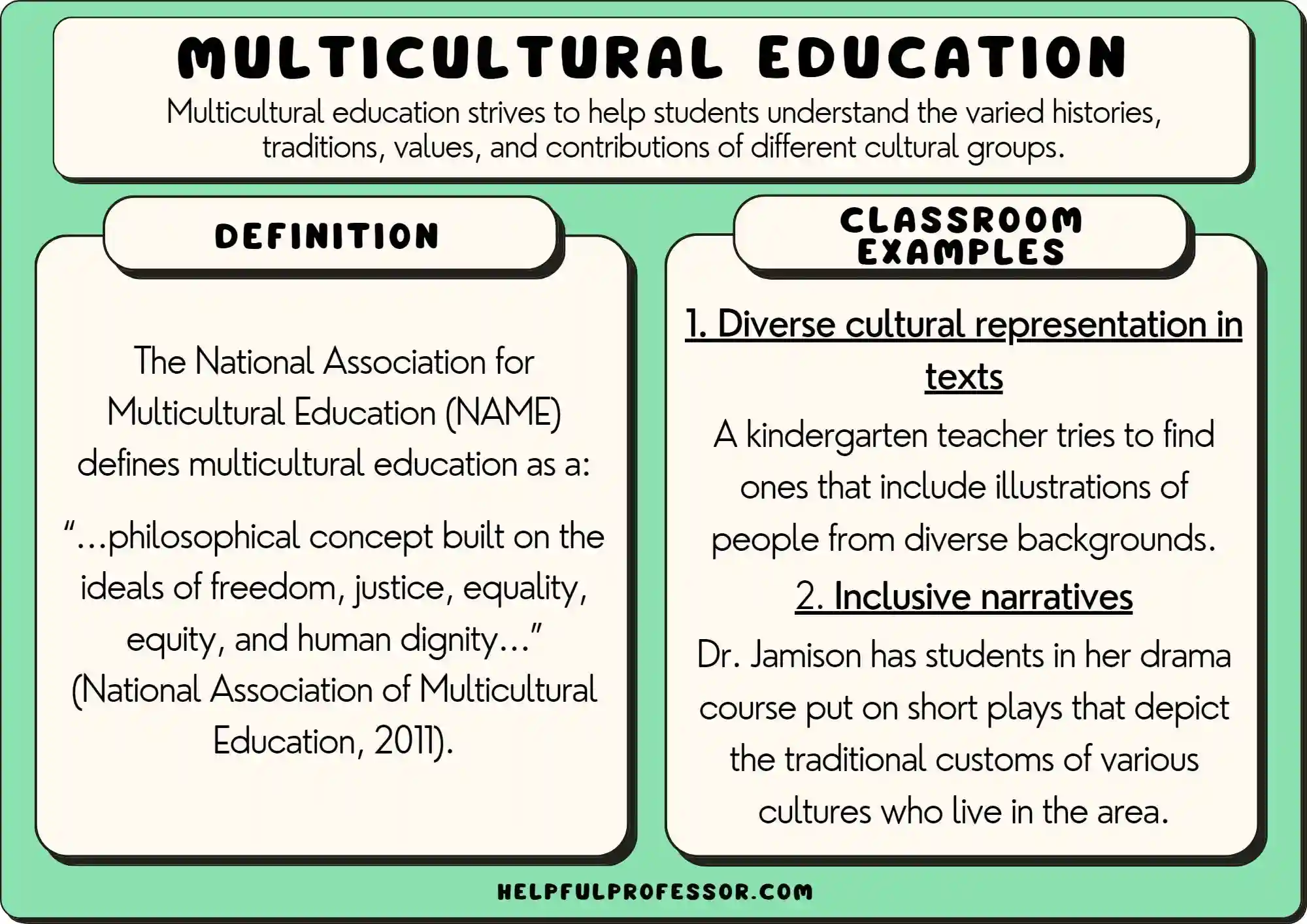

What Is Multicultural Education?

Dive into multicultural education and how it promotes diversity, inclusion, and equity in classrooms. Learn now!