The Best Refinance Company: Top Picks for 2025

Mia Wilson

Photo: The Best Refinance Company: Top Picks for 2025

Introduction to Refinancing

Refinancing refers to the process of obtaining a new mortgage loan to replace an existing one. This financial strategy has gained immense importance in the landscape of personal finance, especially for homeowners looking to optimize their financial standing. As homeowners seek to reduce their monthly mortgage payments, access better interest rates, or tap into their home equity, the potential advantages of refinancing become evident.

One of the primary benefits of refinancing is the opportunity to secure a lower interest rate. With fluctuating market conditions, many homeowners find themselves in a position where they can take advantage of lower rates compared to when they first secured their mortgage. This can lead to considerable savings over the loan's term, ultimately enhancing their financial health. Additionally, refinancing can help consolidate debt, allowing homeowners to replace high-interest debt with a single, lower-interest mortgage payment, thus easing the financial burden.

Moreover, refinancing may also provide homeowners with the chance to switch from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage. This transition offers stability and predictability in monthly payments, safeguarding homeowners against market volatility. Furthermore, refinancing can facilitate home improvements or significant upgrades by leveraging the accrued equity in the property, hence increasing the home's overall value.

It is vital, however, to choose the right refinance company. The selection process can significantly impact the efficiency of the refinancing experience, from interest rates to service quality. In 2025, with numerous refinancing options available, understanding what refinancing entails and recognizing its benefits will be crucial for homeowners looking to enhance their financial situations effectively.

Understanding Refinancing Options

Refinancing offers homeowners diverse opportunities to manage their mortgage debt effectively. In 2025, several refinancing options are available, each designed to cater to varying financial circumstances and objectives. A comprehensive understanding of these options is essential for homeowners to make informed decisions.

The first option is rate-and-term refinancing. This method alters the interest rate and term of the existing mortgage without changing the loan balance. Homeowners often pursue rate-and-term refinancing to take advantage of lower interest rates, thereby reducing monthly payments or decreasing the overall loan duration. This type is particularly beneficial when market rates drop significantly, allowing borrowers to save money on interest over the life of the loan.

Cash-out refinancing presents another viable option for homeowners. This method involves refinancing the existing mortgage for a higher amount than owed and receiving the difference in cash. Cash-out refinancing is ideal for those looking to access home equity for purposes such as home improvement, debt consolidation, or covering significant expenses. However, it's crucial for borrowers to carefully assess their financial situation, as this method can involve higher monthly payments and an increase in overall debt.

Streamline refinancing is a popular choice for Federal Housing Administration (FHA) and Veterans Affairs (VA) loan holders. This option simplifies the refinancing process with fewer credit checks and documentation requirements. Streamline refinancing is beneficial for those who wish to lower their monthly payments or switch to a more stable interest rate without undergoing a lengthy approval process. It provides a quicker path to refinancing, making it an attractive option for eligible borrowers.

Factors to Consider When Choosing a Refinance Company

When evaluating a refinancing company, several critical factors can significantly influence the overall experience and financial outcome for homeowners. One of the foremost considerations is the interest rates offered by the refinancing company. Competitive rates can lead to substantial savings over the loan term, making it essential to compare various lenders' rates and associated terms.

The next aspect to scrutinize is the customer service ratings of the refinancing company. A company with a reputation for excellent customer support can provide valuable guidance throughout the refinancing process. Homeowners should research online reviews and testimonials from past clients, as these insights can offer a clearer picture of the company’s responsiveness and reliability.

Additionally, the speed of the application process is a vital factor, particularly for homeowners looking to take advantage of current market conditions. A refinance company that can process applications quickly not only alleviates stress but also demonstrates efficiency in getting the best rates promptly. Homeowners should inquire about the typical timeframe from application submission to loan approval.

Loan terms also warrant careful consideration as they can affect monthly payments and the overall cost of borrowing. Different companies may offer varying terms, including adjustable or fixed-rate mortgages, which can each come with distinct merits and drawbacks. Therefore, understanding one’s financial goals is key to selecting the right loan structure.

Another crucial area to evaluate involves fees associated with refinancing. Origination fees, closing costs, and prepayment penalties can all impact a homeowner’s decision. Obtaining a clear breakdown of these costs from potential refinance companies can aid in making a well-informed choice.

Lastly, the overall reputation of the refinance company should not be overlooked. Trustworthy firms typically have a track record of ethical practices, transparency, and customer satisfaction. By taking the time to research and compare these factors, homeowners can find a refinance company that best aligns with their needs and financial objectives.

Top Refinance Companies for 2025

As we approach 2025, the refinancing landscape continues to evolve, offering both homeowners and investors numerous options to streamline their financial commitments. Below is a curated list of some of the best refinance companies that stand out in the marketplace for their services, competitive interest rates, and overall customer satisfaction.

One of the leading players is Quicken Loans. Known for its user-friendly online application process, Quicken Loans offers a wide range of refinance products including conventional and government-backed loans. With interest rates that are often lower than the industry average and a reputation for exceptional customer service, they frequently receive high ratings from homeowners across the country. Furthermore, their innovative technology allows clients to track their loan status in real-time.

Another notable option is Better.com. This company has made a name for itself by providing a fully digital platform that simplifies the refinancing process. Lower origination fees and competitive interest rates are among their key features. Customer reviews highlight their fast processing times and transparent fee structures, which contribute to a favorable borrowing experience.

LoanDepot also deserves mention with its wide array of refinancing offerings. This company distinguishes itself by promising a “No Closing Costs” option, which can be appealing to many homeowners looking to reduce upfront expenses. Their customer service is praised for providing personalized assistance, making them a reliable choice for those navigating the complexities of refinancing.

Lastly, Wells Fargo remains a strong contender, providing established credibility and a broad range of refinance options. With robust customer feedback and competitive terms, they cater to varied borrower needs, ensuring flexibility and access to various refinancing solutions.

These companies represent a selection of the top refinancing options for 2025, with each offering unique benefits tailored to meet diverse needs in the current financial climate.

Case Studies: Real Life Success Stories

Refinancing a mortgage is a significant financial decision that can lead to long-term benefits when executed properly. Several homeowners have successfully navigated this process with the assistance of top refinance companies, each facing unique challenges along the way. These case studies exemplify the diverse scenarios in which homeowners leveraged refinancing to enhance their financial positions.

One notable case involved a couple, Sarah and John, who were struggling with high-interest rates on their initial mortgage. With the rising interest environment, their payments were becoming unmanageable. They turned to XYZ Refinance Company after researching their reputation for customer service and competitive rates. Through XYZ’s comprehensive analysis of their financial situation, they were able to refinance at a significantly lower interest rate. This decision not only reduced their monthly payments but also provided them with additional funds to put towards home renovations, ultimately increasing the value of their property.

Another case centers on Maria, a single homeowner facing the challenge of fluctuating income due to freelance work. Concerned about her ability to maintain the mortgage payments, Maria sought help from ABC Refinance Services. They worked with her to develop a tailored refinancing plan that included flexible repayment options. Through this process, Maria was able to consolidate her debts, lower her monthly expenditures, and even build up her savings in a stability fund. ABC’s consultative approach assured her that she was making sound financial choices.

These cases highlight the importance of selecting the right refinance company. Homeowners can benefit from professional guidance tailored to their individual circumstances. These testimonials demonstrate that understanding the unique offerings of refinance companies is essential for aligning homeowners’ financial goals with practical solutions.

Practical Tips for a Successful Refinance Process

Refinancing a mortgage can be a strategic move for homeowners seeking to lower their interest rates, decrease monthly payments, or access equity. To ensure a seamless refinance experience, it is critical to approach the process methodically. First, homeowners should assess their current financial situation by reviewing credit scores, income stability, and existing debt obligations. A strong credit score can significantly enhance leverage when negotiating terms with lenders, so improving it before applying for refinancing is advisable if needed.

Next, gathering the necessary documentation is vital. Typical requirements include proof of income, tax returns, bank statements, and details of current loan agreements. Having these documents organized can expedite the refinancing process, allowing borrowers to present a clear financial picture to lenders. Additionally, it is wise to prepare a list of questions regarding loan terms, mortgage insurance, and any associated fees to facilitate informed discussions with potential lenders.

Research is also essential when selecting a refinance company. Homeowners should compare offers from multiple lenders, focusing on interest rates, closing costs, and the overall reputation of the companies. Utilize online tools and resources to analyze different options and consult reviews or ratings to gauge customer satisfaction with refinancing experiences. Furthermore, timing can play a crucial role monitoring market trends and interest rates can help homeowners decide the optimal time to refinance financially.

Understanding the refinancing process itself is equally important. Homeowners should expect an initial application review, followed by a more comprehensive underwriting process where lenders assess risk. Throughout the journey, maintaining open communication with your chosen lender can alleviate uncertainties and enhance clarity. A proactive approach combined with these practical tips will ultimately contribute to a successful refinancing outcome, leading to better financial well-being.

Common Mistakes to Avoid When Refinancing

Refinancing a mortgage is a significant financial decision that can lead to substantial savings or unexpected costs. To ensure a smooth experience, it is essential to be aware of common mistakes that borrowers often encounter. One of the frequent misconceptions is related to timing. Many homeowners believe that interest rates are bound to drop, leading them to delay refinancing. However, rates can fluctuate unpredictably, and waiting too long might hinder the opportunity to lock in a lower rate. It is prudent to monitor the market actively and assess personal financial situations to determine whether refinancing is beneficial at a specific time.

Another pitfall is overlooking unnecessary fees associated with refinancing. Often, borrowers may be so focused on reducing their monthly payments that they disregard other costs, such as closing fees or points. It is vital to thoroughly read the fine print, as these fees can negate the savings from a lower interest rate. Before agreeing to refinance, applicants should request a Loan Estimate from lenders to break down all associated costs. By comparing different loan offers, individuals can identify options that minimize fees and optimize savings.

Additionally, how one handles lender offers can significantly impact their refinancing experience. Borrowers may receive multiple offers but may unintentionally rush into accepting the first appealing one. It is essential to take the time to evaluate each offer carefully, focusing on interest rates, terms, and conditions. Seeking pre-approval from multiple lenders allows for comparison and can afford more leverage in negotiating better terms. Understanding the implications of each offer will empower borrowers to make informed decisions, safeguarding them from costly mistakes during the refinancing process.

FAQs About Refinancing in 2025

As the landscape for refinancing evolves, prospective homeowners and current mortgage holders may have numerous questions. Understanding the eligibility criteria for refinancing in 2025 is crucial. Generally, borrowers must have a stable income, a credit score typically above 620, and sufficient equity in their homes. Lenders will evaluate the borrower’s debt-to-income ratio, which should ideally remain below 43%. Elevated scores offer better refinancing rates, while lower scores may benefit from government-backed loans that cater to borrowers with less-than-perfect credit.

Timelines for refinancing can significantly vary based on individual circumstances and market conditions. Homeowners should anticipate a process that averages between 30 to 45 days, although it can be shorter or longer. Factors influencing this timeline include property appraisals, documentation requests, and lender processing speeds. Engaging with a knowledgeable refinancing consultant can streamline the process and ensure all necessary paperwork is submitted promptly.

Evaluating the financial implications of refinancing is also essential. While refinancing can potentially lower monthly payments, reduce interest rates, or change loan terms, it may come with closing costs that range between 2% to 5% of the loan amount. Homeowners must calculate their break-even point the duration it will take to recoup those costs through savings. In some scenarios, homeowners might opt for cash-out refinancing, which allows them to tap into their home’s equity for other expenses, such as home renovations or debt consolidation. However, this comes with its own set of risks, requiring careful financial analysis.

Overall, staying informed about these essential aspects of refinancing in 2025 can empower homeowners to make educated decisions. Understanding eligibility, timelines, and financial implications is vital for achieving desirable refinancing outcomes, ultimately enhancing homeownership satisfaction.

Conclusion and Call to Action

In the realm of personal finance, particularly regarding home loans, selecting the best refinance company is a pivotal decision that can greatly influence one’s financial trajectory. Throughout this article, we have examined various criteria essential for making an informed choice, including interest rates, customer service quality, and the range of refinancing options available. These factors play a crucial role in ensuring that homeowners secure the best possible terms for their mortgage refinancing needs.

The best refinance company for one individual may not suit another, underscoring the importance of personal circumstances and financial objectives. By evaluating options diligently, homeowners can find a lender that aligns with their financial goals, thus facilitating a smoother refinancing process. Moreover, considering the evolving landscape of interest rates and loan terms will further empower consumers to make decisions that not only meet their immediate needs but also support long-term financial health.

We encourage readers to share their experiences and insights related to refinancing, as this collaborative knowledge can aid others in their search for the ideal refinance company. Engaging with fellow homeowners can provide different perspectives and tips that might prove valuable. Furthermore, staying informed through research and regularly checking for changes in interest rates can lead to better outcomes.

We invite you to take action now: explore your refinancing options, investigate various companies, and utilize the information presented in this article to guide your decisions. Your financial future is important, and making the right choice today can pave the way for significant savings and peace of mind tomorrow. Remember, the journey does not end here continue to seek knowledge and engage with others on this important topic.

For You

View AllStay ahead with this essential car maintenance checklist. Keep your vehicle running smoothly and avoid costly repairs. Learn now!

Mia Wilson

Understand macronutrients and micronutrients to optimize your diet. Learn the differences now!

Mia Wilson

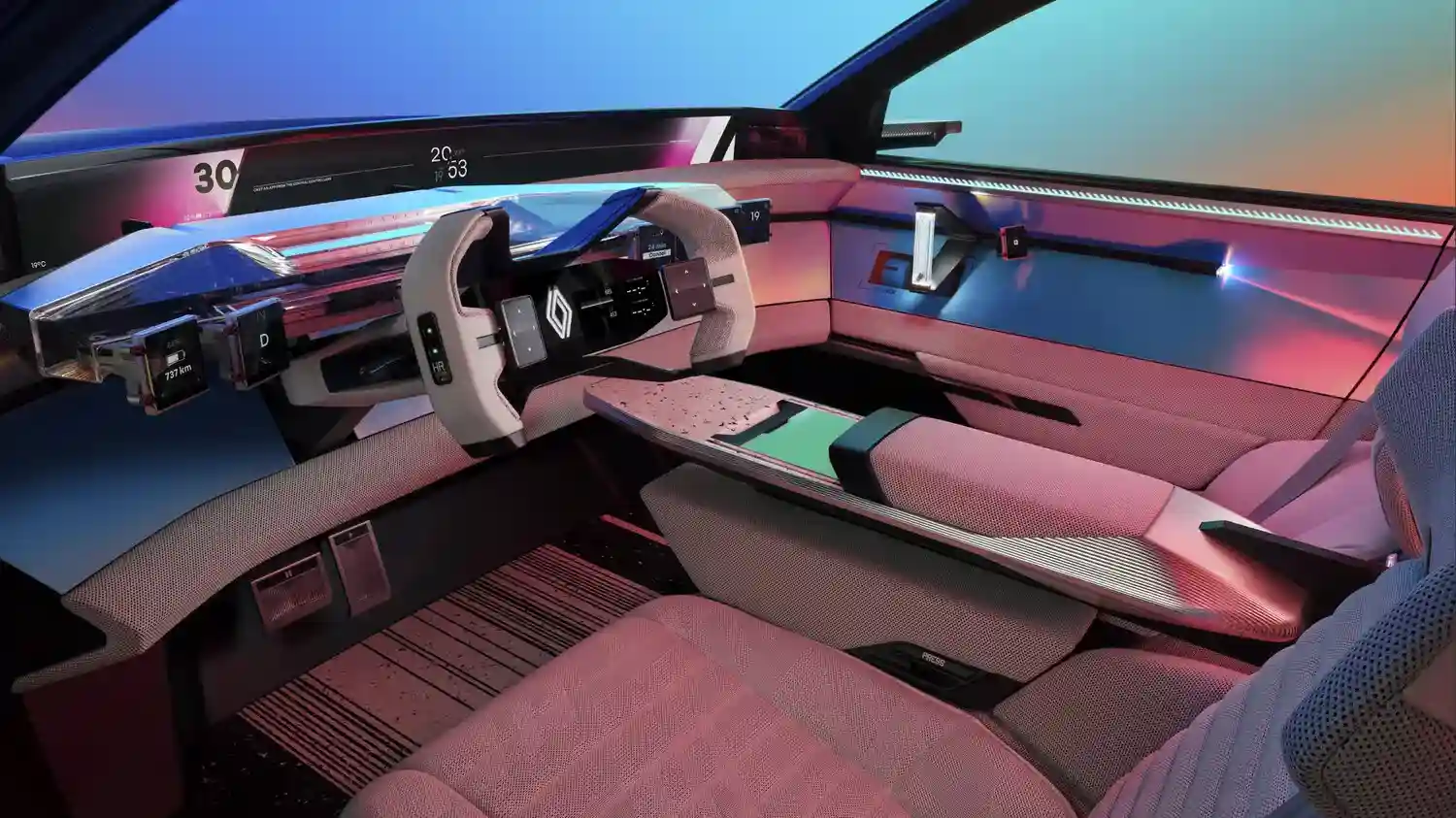

Explore the top car interior design trends, from luxurious materials to smart tech integration. Elevate your driving experience!

Mia Wilson

Discover how the automotive supply chain operates, from sourcing materials to delivering finished cars. Stay informed!

Mia Wilson

Explore the basics of consumer behavior theory and its impact on marketing strategies. Click to understand buying habits!

Mia Wilson

Explore the essential nutrients for a balanced diet and enhance your nutrition today! Click to learn more.

Mia Wilson

Health

Education

View All

April 14, 2025

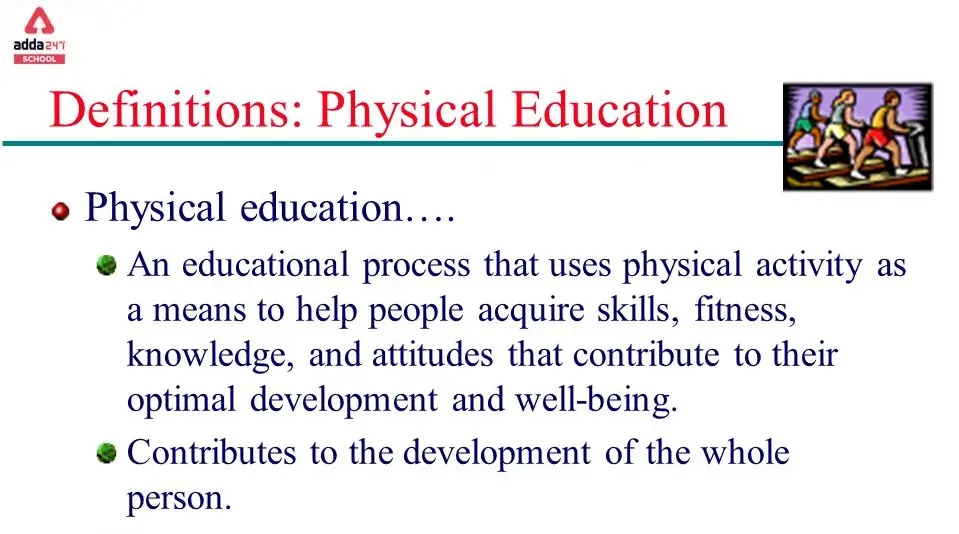

What Is Physical Education? Explained!

Discover the importance of physical education, its benefits, and why it's crucial for overall development. Learn more now!

May 4, 2025

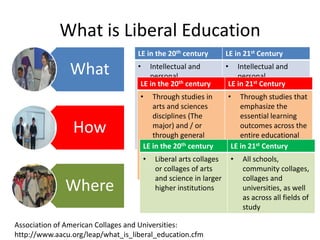

What Is Liberal Education? Explained!

Discover what liberal education is, its benefits, and how it fosters critical thinking and lifelong learning. Learn more now!

May 19, 2025

What Is Tertiary Education?

Understand tertiary education, its levels, and how it prepares students for advanced careers. Explore your options now!