What Are Derivatives? Explained Simply

Mia Wilson

Photo: What Are Derivatives? Explained Simply

What Are Derivatives? Explained Simply

Derivatives are financial instruments that derive their value from an underlying asset. They play a significant role in global financial markets by helping individuals and institutions manage risks, speculate on price movements, and gain access to otherwise hard-to-trade markets. Although the concept may seem complex at first glance, derivatives can be explained in a simple and digestible manner.

This article provides a clear and concise explanation of what derivatives are, their common types, how they work, and their importance in finance. By the end of this piece, you’ll understand why derivatives are essential for modern financial systems and how they impact everyday economic activities.

Understanding Derivatives: The Basics

In finance, a derivative is a contract between two or more parties, where the value of the contract depends on or is derived from an underlying asset or group of assets. These underlying assets can include stocks, bonds, commodities, interest rates, currencies, or even market indexes.

Key Characteristics of Derivatives:

- Contractual Agreement: A derivative is a legally binding agreement between parties.

- Underlying Asset: The value of the derivative is based on the performance of an asset.

- Leverage: Derivatives often allow traders to control large positions with relatively small amounts of capital, a feature known as leverage.

- Settlement Date: Each derivative contract has a predetermined expiration or settlement date.

Derivatives are commonly used by two main groups: hedgers and speculators. Hedgers use derivatives to protect themselves from adverse price movements in the market, while speculators aim to profit from price fluctuations.

Types of Derivatives

There are several types of derivatives, each serving a specific purpose. Below are the most common ones:

1. Futures Contracts

A futures contract is an agreement between two parties to buy or sell an asset at a predetermined price on a specific future date. These contracts are standardized and traded on exchanges.

- Example: A farmer may use a futures contract to lock in a selling price for their crop, ensuring they are not adversely affected by a drop in prices.

2. Options Contracts

An options contract gives the buyer the right, but not the obligation, to buy or sell an asset at a predetermined price before a specified expiration date. Options come in two forms: call options (which allow the purchase of an asset) and put options (which allow the sale of an asset).

- Example: An investor holding shares in a company may buy a put option to protect against a potential decline in the stock's price.

3. Swaps

Swaps are agreements between two parties to exchange cash flows or other financial instruments. The most common types are interest rate swaps, where parties exchange fixed interest payments for floating-rate payments, and currency swaps, which involve exchanging principal and interest payments in different currencies.

- Example: A company with a variable interest rate loan might enter into an interest rate swap to reduce its exposure to fluctuating interest rates.

4. Forward Contracts

A forward contract is similar to a futures contract but differs in that it is not standardized or traded on an exchange. Instead, it is a private agreement between two parties.

- Example: A multinational corporation might use forward contracts to hedge against currency risk when planning a cross-border transaction.

How Derivatives Work: A Simplified Example

Let’s consider a simple example to understand how derivatives function. Imagine an airline company concerned about fluctuating fuel prices. Since fuel costs represent a significant part of its expenses, the airline may enter into a futures contract to buy fuel at a fixed price for the next six months.

If fuel prices rise, the airline benefits because it locked in a lower price. On the other hand, if prices fall, the airline still has to pay the agreed price, but the certainty provided by the contract helps in budgeting and financial planning.

This example illustrates how derivatives can be used to mitigate risk, ensuring that businesses can focus on operations without worrying about unpredictable price swings.

The Importance of Derivatives in Financial Markets

Derivatives serve several critical functions in financial markets:

1. Risk Management

One of the primary uses of derivatives is to manage financial risk. Companies, investors, and even governments use derivatives to protect against unfavorable price changes in commodities, currencies, and interest rates.

- Hedging Example: A company that imports raw materials might use currency derivatives to hedge against fluctuations in exchange rates.

2. Price Discovery

Derivatives markets contribute to the process of price discovery, where market participants determine the fair price of an asset based on supply and demand dynamics.

3. Market Efficiency

By facilitating arbitrage opportunities, derivatives help ensure that prices in different markets do not deviate significantly from each other, promoting market efficiency.

4. Access to Otherwise Inaccessible Markets

Derivatives provide exposure to assets or markets that may otherwise be difficult or costly to access. For example, investors can gain exposure to commodities like oil or gold without having to physically purchase and store these assets.

Risks Associated with Derivatives

While derivatives offer numerous benefits, they also come with risks:

- Counterparty Risk: The risk that one party may default on the contract.

- Leverage Risk: The use of leverage can amplify both gains and losses.

- Liquidity Risk: Some derivatives may be difficult to buy or sell quickly without affecting their price.

- Complexity: Certain derivatives can be highly complex and may require advanced financial knowledge to manage effectively.

For these reasons, derivatives are best used by those who understand the associated risks and have the resources to manage potential losses.

Conclusion: Why Understanding Derivatives Matters

Derivatives may seem like a complex part of the financial world, but their role in modern markets is vital. They help manage risk, enhance liquidity, and improve market efficiency. Whether you are a business owner looking to hedge risks or an investor seeking new opportunities, understanding derivatives can provide valuable insights into financial decision-making.

However, it’s essential to approach derivatives with caution, given their inherent risks. With proper knowledge and strategy, derivatives can be powerful tools for achieving financial goals while mitigating potential downsides.

By demystifying derivatives, this article aims to equip readers with the foundational knowledge needed to navigate the world of financial instruments confidently. Whether you’re new to finance or seeking to deepen your understanding, derivatives are worth exploring further.

For You

View AllDiscover effective strategies to protect your VPS from cyber threats.

Mia Wilson

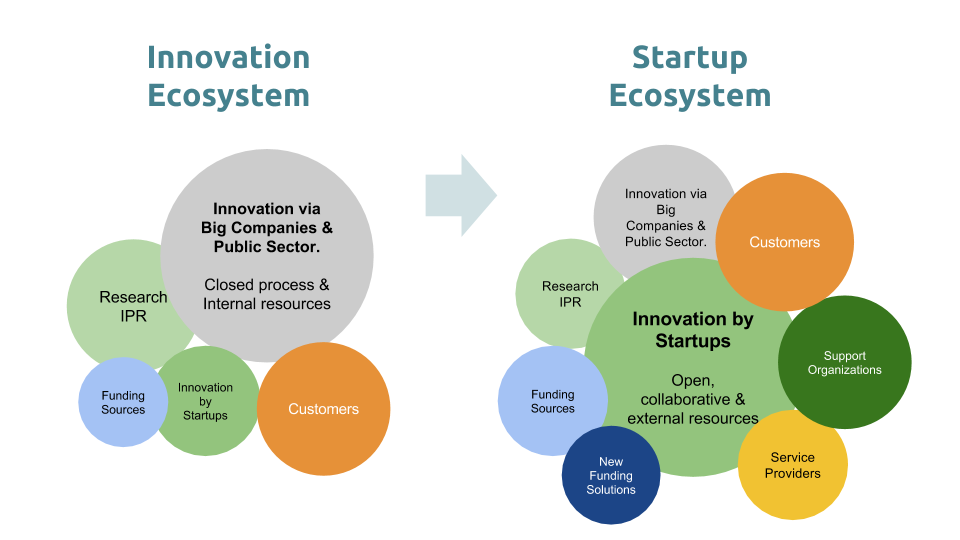

Learn about the startup ecosystem, key players, and what drives innovation. Click to explore this vibrant community!

Mia Wilson

Embark on your solo adventure confidently with these 10 essential tips. From safety to planning, make your trip unforgettable!

Mia Wilson

Make family vacations affordable with these budget travel hacks. Enjoy fun trips without breaking the bank!

Mia Wilson

Find out if a VPS is the ideal solution for your business hosting needs.

Mia Wilson

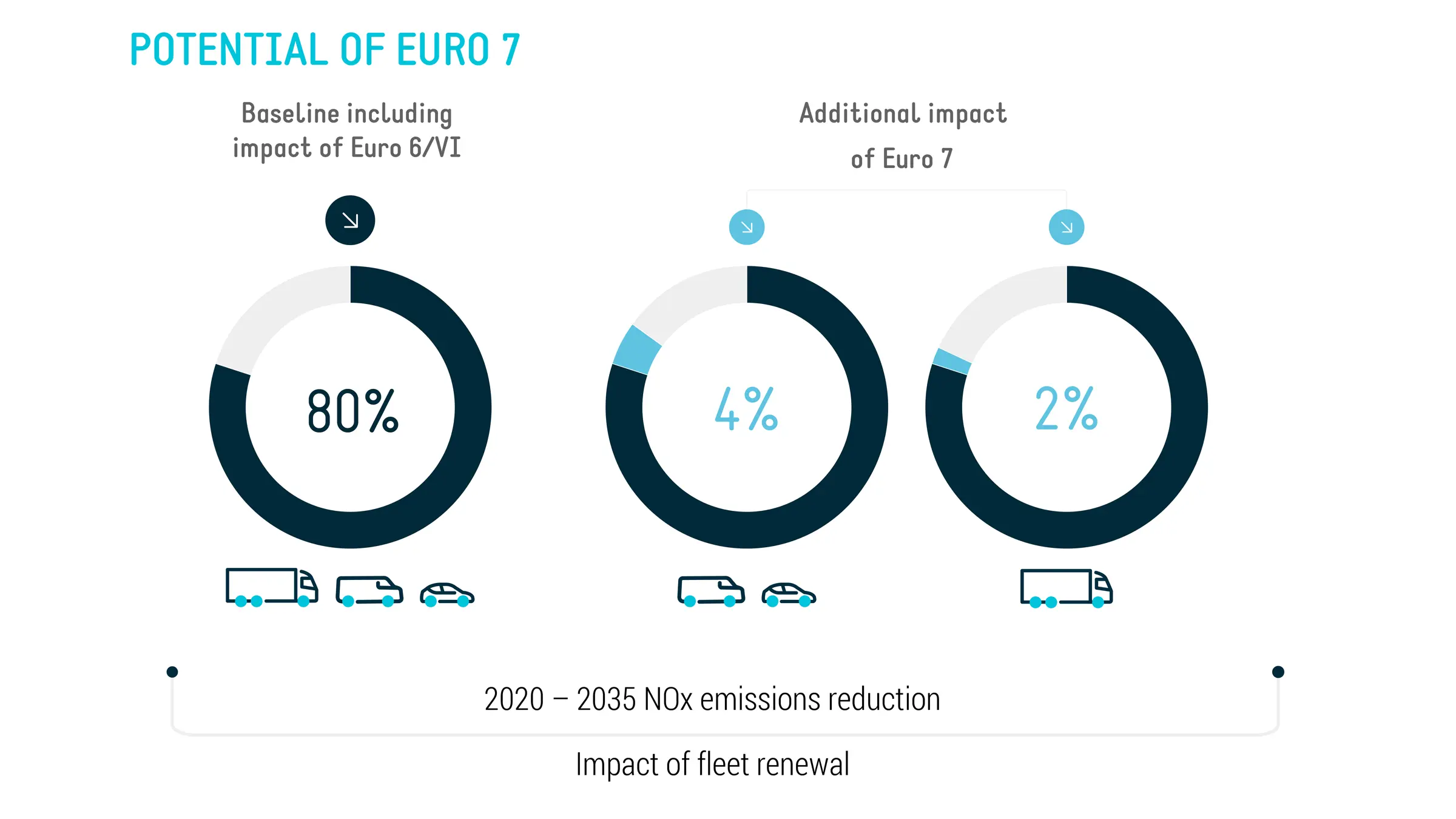

Understand Euro 6 emission standards and their impact on car manufacturing and air quality. Stay informed on environmental policy!

Mia Wilson

Education

View All

April 23, 2025

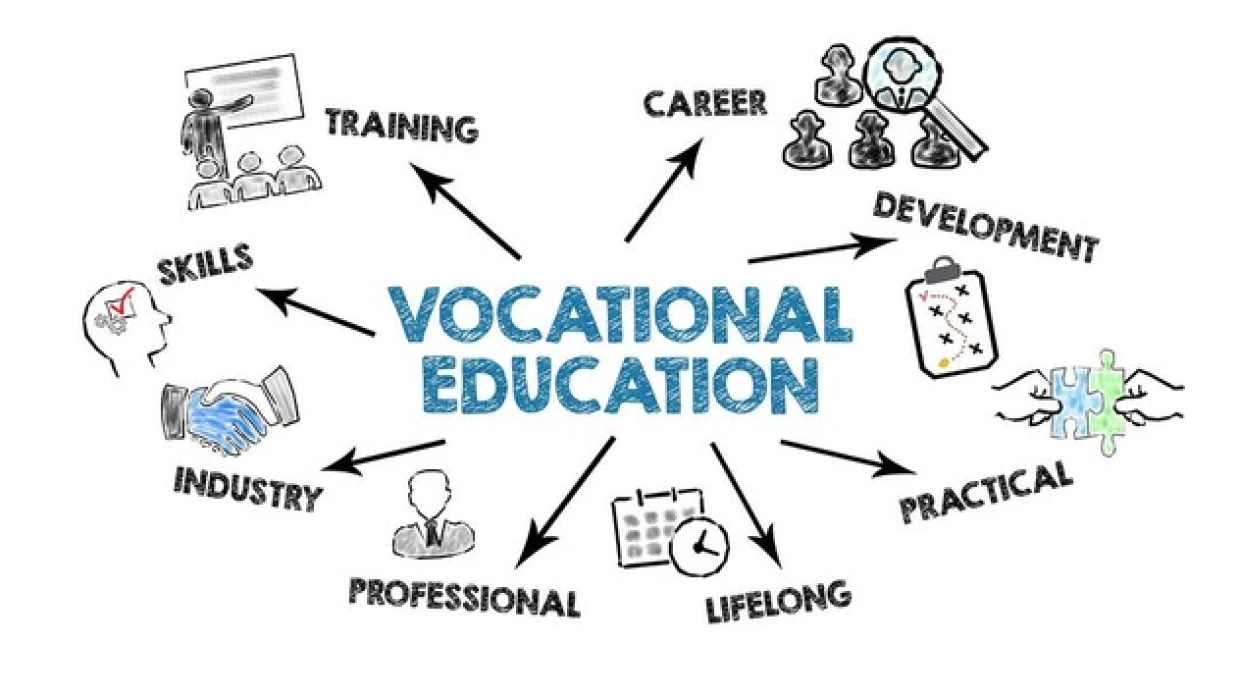

What Is Vocational Education?

Understand vocational education and how it prepares individuals for hands-on careers. Explore practical learning today!

April 22, 2025

What Is Early Childhood Education?

Explore early childhood education, its benefits, and how it shapes a child’s future. Start building strong foundations!

April 17, 2025

What Is Secondary Education? Explained!

Learn about secondary education, its structure, and its role in shaping academic and career paths. Get insights today!