What Is Inflation and Why It Matters?

Mia Wilson

Photo: What Is Inflation and Why It Matters?

What Is Inflation and Why It Matters?

Inflation is a term that appears frequently in discussions about the economy, but what exactly does it mean? At its core, inflation refers to the sustained increase in the general price level of goods and services in an economy over a period of time. While a certain level of inflation is normal and even necessary for economic growth, excessive inflation can lead to significant economic challenges. This article delves into the concept of inflation, explores its causes, examines its impact on everyday life, and highlights why it matters to individuals, businesses, and policymakers.

Understanding Inflation: A Brief Overview

Inflation is typically measured by changes in price indices such as the Consumer Price Index (CPI) or the Producer Price Index (PPI). The CPI tracks the price of a basket of consumer goods and services, including essentials like food, housing, and transportation, while the PPI measures the average change in selling prices received by domestic producers. When these indices show a consistent upward trend, inflation is said to be occurring.

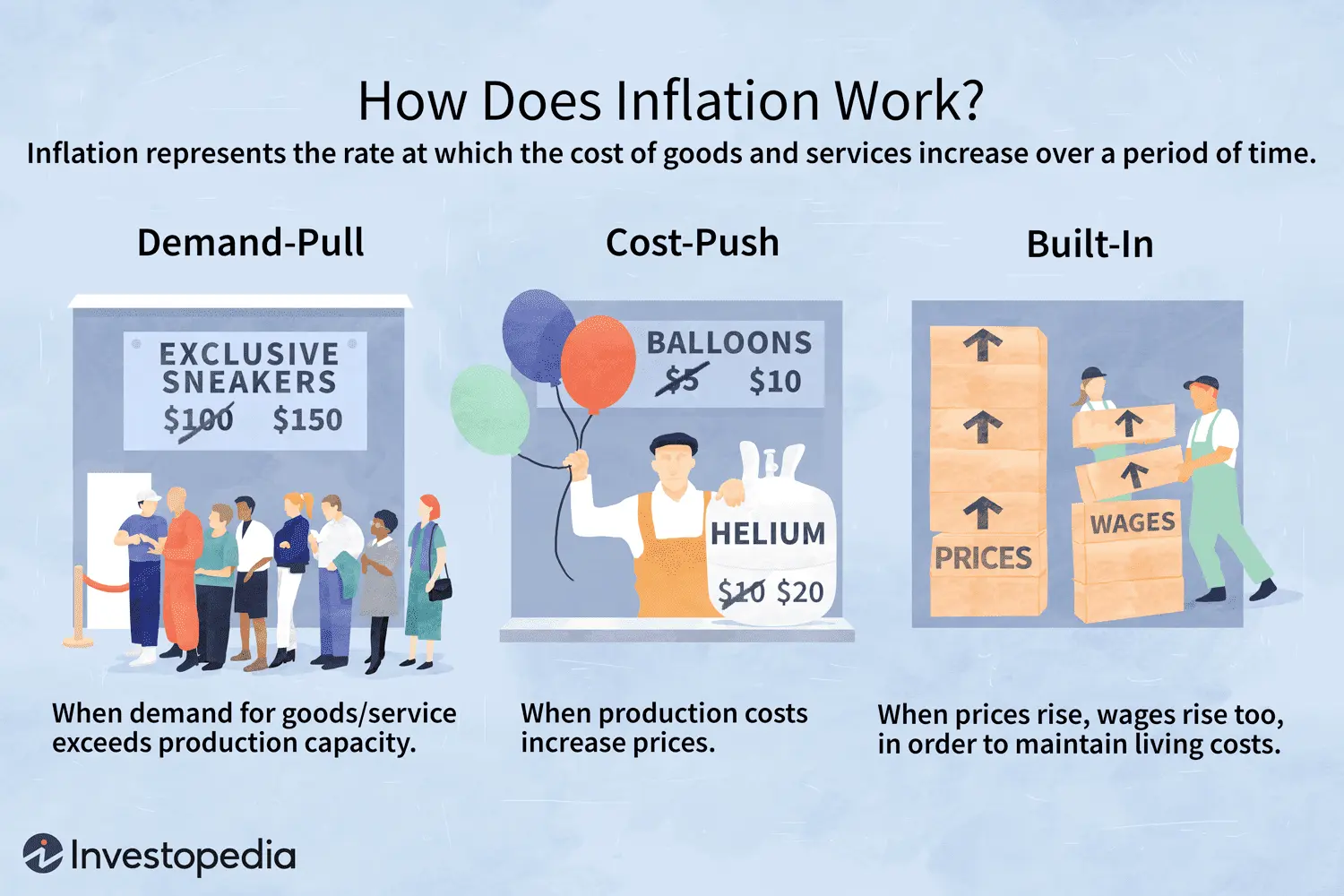

There are three primary types of inflation:

- Demand-Pull Inflation: This occurs when demand for goods and services outpaces supply. An expanding economy, increased consumer spending, and government stimulus programs are common drivers of demand-pull inflation.

- Cost-Push Inflation: This type arises when production costs, such as wages and raw materials, increase, leading businesses to raise prices to maintain profitability. Supply chain disruptions and rising energy costs are typical triggers.

- Built-In Inflation: Often referred to as wage-price inflation, this occurs when workers demand higher wages to keep up with rising costs of living, prompting businesses to increase prices, resulting in a feedback loop.

Causes of Inflation: Why Do Prices Rise?

Inflation can be driven by a variety of factors, and understanding these causes is crucial for both policymakers and the general public. Some common causes include:

Monetary Policy

Central banks, such as the Federal Reserve in the United States, control the money supply through monetary policy. When interest rates are low, borrowing becomes cheaper, encouraging spending and investment. While this can stimulate economic growth, it can also lead to inflation if demand outstrips supply.

Supply Chain Disruptions

Global supply chains are intricate systems that can be easily disrupted by events such as natural disasters, geopolitical conflicts, or pandemics. These disruptions reduce the availability of goods, leading to higher prices.

Increased Production Costs

When the cost of key inputs like labor, raw materials, and energy rises, businesses pass these costs onto consumers in the form of higher prices. A sharp increase in oil prices, for example, can have a ripple effect across various industries, from transportation to manufacturing.

Why Inflation Matters: Its Impact on Society

Inflation affects almost every aspect of daily life, from the prices of basic goods to long-term financial planning. Here’s a closer look at why inflation matters:

Purchasing Power Erosion

Inflation erodes the purchasing power of money, meaning that over time, consumers can buy fewer goods and services with the same amount of money. For individuals on fixed incomes, such as retirees, this can significantly impact their quality of life.

Impact on Savings and Investments

When inflation is high, the real value of savings decreases unless interest rates on savings accounts and investments keep pace with inflation. Conversely, certain types of investments, such as real estate and commodities, may perform well during inflationary periods, offering a potential hedge.

Business Planning and Profitability

Inflation introduces uncertainty into business planning. Companies must carefully manage costs, pricing, and wages to maintain profitability. Persistent inflation may also prompt businesses to reduce investments or cut jobs, potentially slowing economic growth.

How Policymakers Respond to Inflation

Governments and central banks play a crucial role in managing inflation. Their primary objective is to strike a balance between promoting economic growth and keeping inflation at a manageable level.

Monetary Policy Tools

Central banks use several tools to control inflation, including:

- Raising Interest Rates: Higher interest rates make borrowing more expensive, reducing spending and investment, which can help curb inflation.

- Open Market Operations: By selling government bonds, central banks can reduce the money supply, thereby decreasing inflationary pressure.

Fiscal Policy Measures

Governments can also influence inflation through fiscal policy by adjusting tax rates and public spending. Reducing government spending or increasing taxes can lower demand, helping to control inflation.

Historical Examples of Inflation

Throughout history, inflation has played a pivotal role in shaping economies and societies. Some notable examples include:

- The Great Inflation of the 1970s: In the United States, this period was characterized by double-digit inflation rates, driven by oil price shocks and monetary policy missteps. It led to significant economic stagnation and prompted a shift in monetary policy approaches.

- Hyperinflation in Zimbabwe: In the late 2000s, Zimbabwe experienced one of the worst cases of hyperinflation in history, with inflation rates reaching astronomical levels. This was primarily due to excessive money printing and poor economic policies.

Inflation in the Modern World: Current Trends

In recent years, inflation has been a hot topic globally, driven by factors such as the COVID-19 pandemic, supply chain disruptions, and expansive monetary policies. As economies recover from the pandemic, central banks face the challenge of tightening monetary policy without derailing economic growth.

According to the International Monetary Fund (IMF), global inflation reached record highs in 2022, with some regions experiencing inflation rates above 10%. This prompted several central banks, including the Federal Reserve and the European Central Bank, to raise interest rates aggressively.

Conclusion: Staying Informed About Inflation

Inflation is a complex economic phenomenon that affects everyone, from consumers and businesses to investors and policymakers. Understanding its causes, impact, and the measures taken to control it can help individuals make more informed financial decisions. Whether it’s planning for retirement, managing investments, or running a business, staying informed about inflation trends is crucial in navigating an ever-changing economic landscape.

As inflation continues to be a key factor in the global economy, keeping an eye on indicators such as interest rates, price indices, and government policies will help individuals and businesses adapt to changing economic conditions.

For You

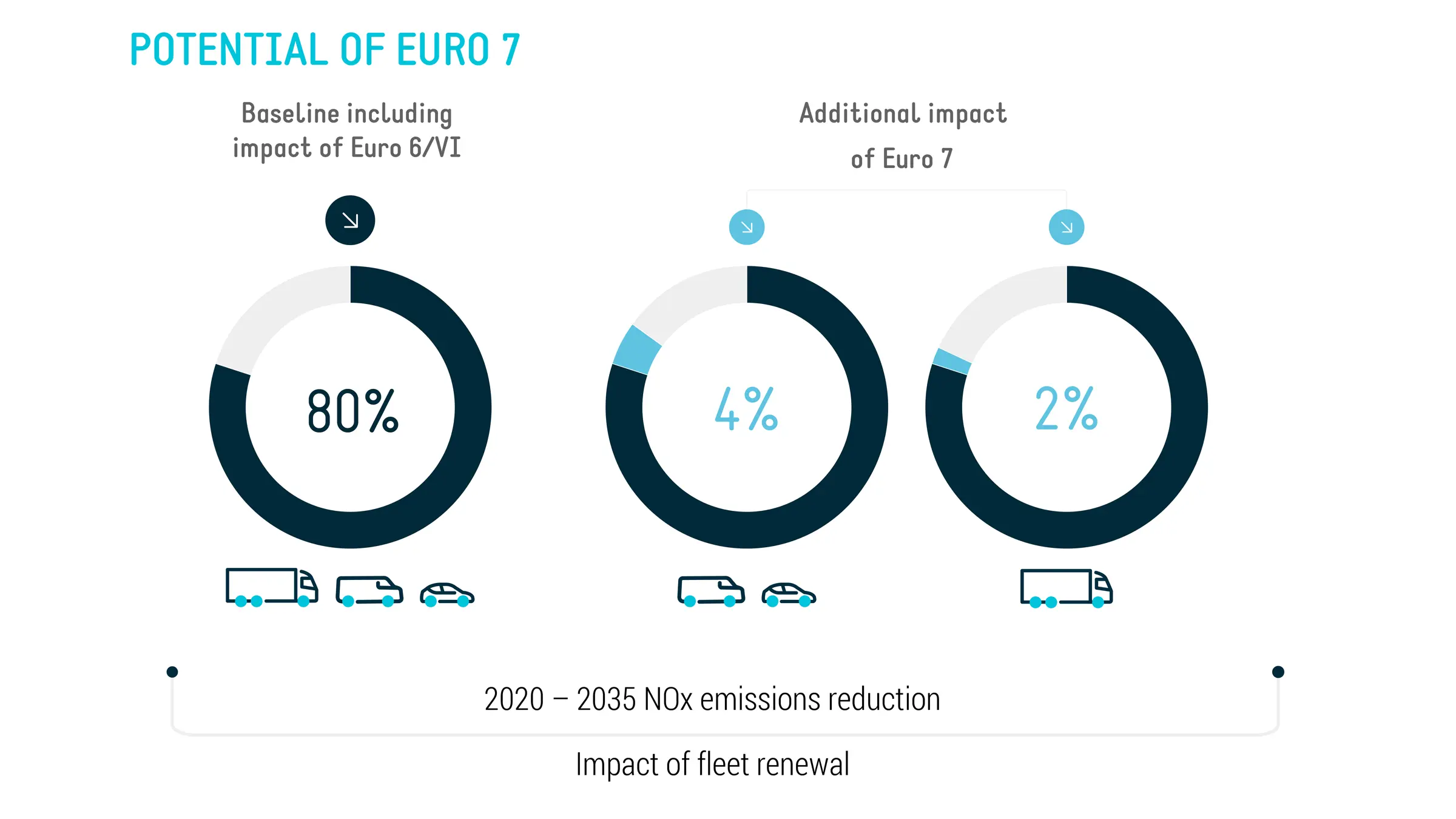

View AllUnderstand Euro 6 emission standards and their impact on car manufacturing and air quality. Stay informed on environmental policy!

Mia Wilson

Learn how blockchain is powering the NFT market and what it means for creators.

Mia Wilson

Learn how VPS hosting boosts website performance and speeds up loading times.

Mia Wilson

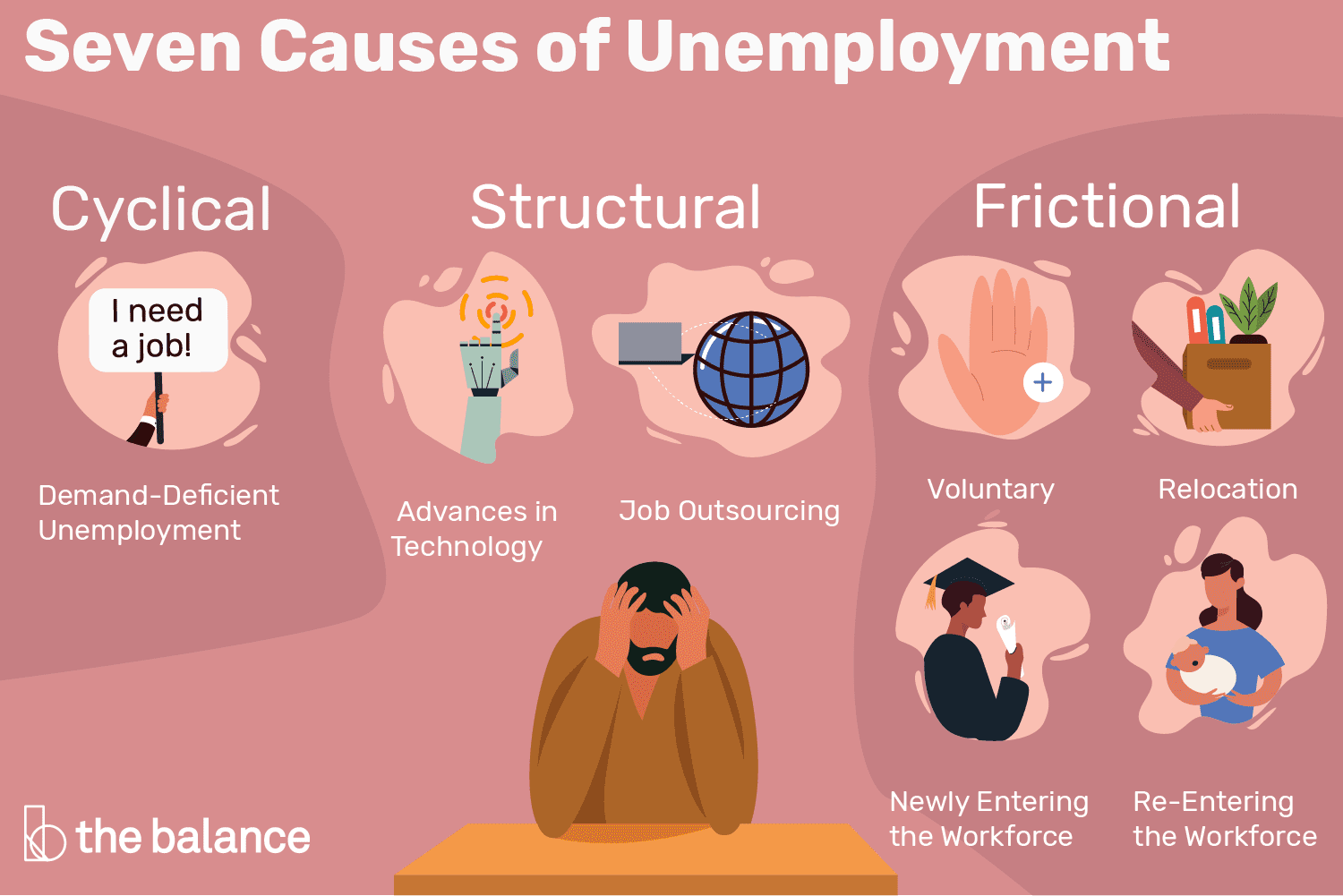

Dive into the main causes of unemployment and how they affect the economy. Learn more about this critical issue!

Mia Wilson

Get insights into VPS hosting prices and how to choose an affordable plan.

Mia Wilson

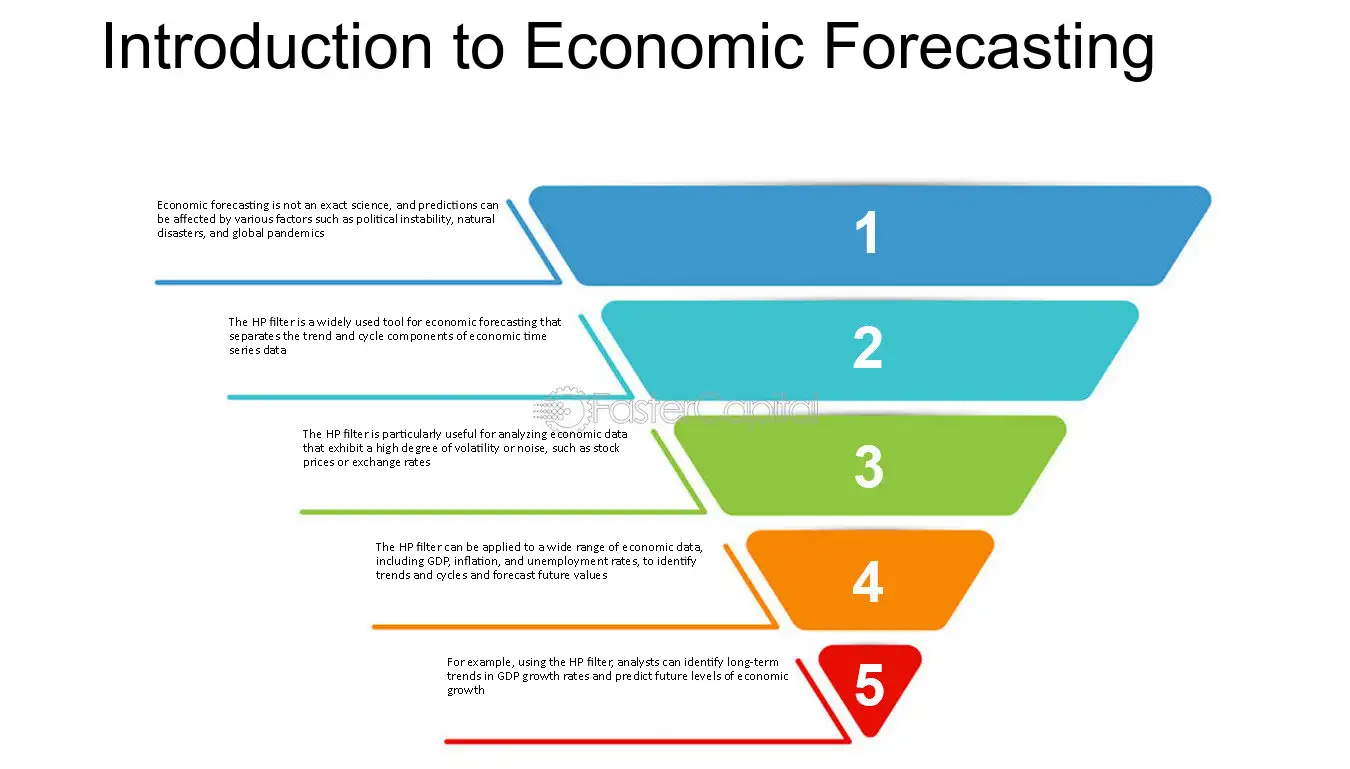

Explore various economic forecasting methods and their importance in decision-making. Click to gain clear insights!

Mia Wilson

Education

View All

April 24, 2025

What Is Distance Education? Explained!

Discover how distance education works, its benefits, and how it’s transforming learning. Start your journey today!

April 17, 2025

What Is Secondary Education? Explained!

Learn about secondary education, its structure, and its role in shaping academic and career paths. Get insights today!

April 16, 2025

Why Is Education Important?

Explore why education is vital for personal growth, career success, and societal progress. Start learning now!